Cash flow forecasting gives you more detail and insight on when and how you will be paying and receiving payments.

At a high level it alerts you to any cash gaps, so you can take early remedial action. It also helps you see when you’ll have a cash surplus, letting you confidently put your cash to better use in things like interest-bearing accounts, or investing it back into your business.

Already got the basics covered? Jump ahead with the linked headers below:

- What is a cash flow forecast?

- Understanding the difference between profit and cash flow

- What are the advantages of cash flow forecasting?

- What are the disadvantages of cash flow forecasting?

- The benefits of cash flow forecasting explained

- Creating your first cash flow forecast

- Free cash flow template

What is a cash flow forecast?

In the most basic sense, cash flow is simply the amount of money that flows into and out of a business during a given period. So, cash flow forecasting involves managing these in and outflows while looking into the future and planning.

Check out our article on the difference between short and long term cash flow forecasting here.

Understanding the difference between profit and cash flow

If you read the above you may have thought to yourself: ‘hey, isn’t that just profit?’

Close but not quite. In fact a few key small differences can make your cash flow very different from your profit.

DYK?: 80% of all businesses fail over a 10 year horizon, and 80% of those businesses fail due to cash flow failures.

Profit is a past measure of operations:

It ignores the timing of inflows and outflows

It smooths amounts and includes estimates

It doesn’t consider balance sheet items

It doesn’t consider the future

Knowing the above we can start to imagine scenarios where a profitable business runs into trouble.

For example: A business makes a sale for $1000, but if they haven’t actually collected payment, there is no money in the bank. Despite profit increasing, until payment is received there is no cash inflow.

Profit also doesn’t take into account estimates made for things like depreciation expenses, which are ultimately just estimates, and may not accurately represent expenses, or may ‘smooth them out’.

What are the advantages of cash flow forecasting?

There’s many advantages to cash flow forecasting, ultimately it gives you a clearer picture of your cash position letting you make informed decisions.

Advantages of cash flow forecasting:

Let’s you see your future cash position/cash balance

Allows you to track overdue payments and receivables

Alerts you to possible cash shortages

Alerts you to periods when you’ll have surplus cash/excess cash

Helps you plan for seasonal differences in earning/spending

Helps you plan your cash inflows and outflows

Can help inform future budgeting

Can help inform business planning

It helps answer operational questions like:

Can my team afford to take on this big project?

How is inflation going to affect my costs compared to this time last year?

Can we hire a new staff member this quarter?

What happens if our biggest client pays late this month?

Is it possible for us to delay a payment?

While cash flow forecasting might initially sound purely like a financial function, it ultimately helps you make better, more confident business decisions.

Disadvantages of cash flow forecasting

The only real disadvantage is time. The more time you spend creating forecasts, chasing numbers, and manipulating spreadsheets, the less time you have for the rest of your business. Something that can have a big impact especially if you’re a small business owner.

Check out our free guide + cash flow forecast template for tips on how you can go from spending hours to minutes on forecasting each month.

The Benefits Of Cash Flow Forecasting Explained

No matter what business or industry you’re in, you can hopefully see how cash flow forecasting would be beneficial. For certain businesses though it is particularly important, and should be a priority in order to avoid cash flow problems.

Typically, smaller businesses in industries with ‘lumpy’ or inconsistent payments will benefit the most. Because these businesses lack consistent inflows and outflows they need to spend more time considering when, and how, they receive and give payments.

Ultimately, short term cash forecasting is critical for businesses where revenues and/or expenses are not steady and predictable – for example: new businesses, growing businesses, businesses changing their operations, and business in certain industries.

Example industries include:

Construction

Non-for-profit

Agencies

Artists

Tourism & Hospitality

Cash flow forecasting is also a great tool for businesses that are paying off debt, and/or looking for credit, getting ready to be acquired, or evaluating a variety of scenarios like expanding, increasing owner draws, and hiring. Depending on your needs and concerns you can create a detailed cash flow forecast down to the day. If you’re more confident in your cash position on a day-to-day basis you can probably get away with weekly or monthly forecasting.

Creating Your First Cash Flow Forecast

Now it’s your turn!

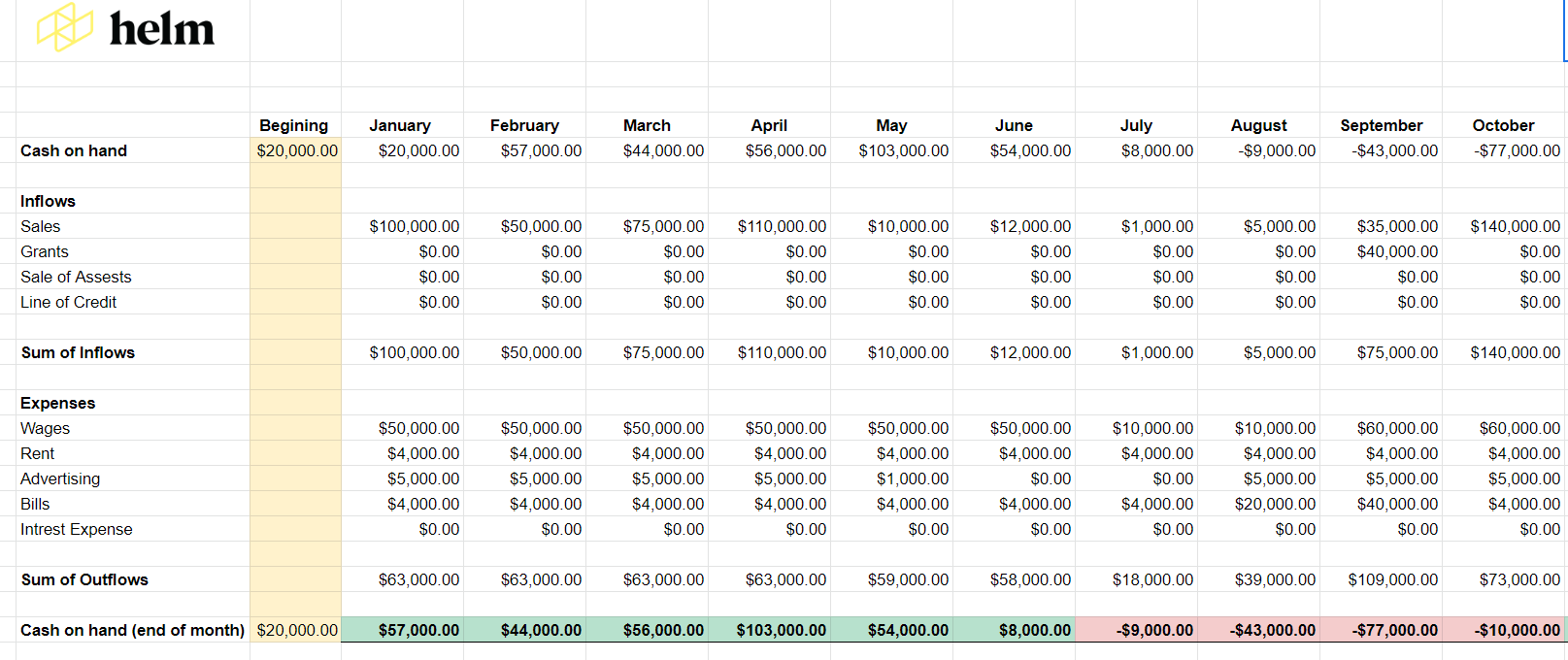

Creating a cash flow forecast is relatively simple, all you need is access to spreadsheet software like excel or google sheets. There are also lots of free templates online (including ours below) that you can use and quickly tailor to your own needs.

At the very minimum you’ll need columns for each time period you want to predict your cash balance, and rows underneath for inflows and outflows. It’s up to you how detailed you make the forecast, often this comes down to a tradeoff between time and accuracy when you’re forecasting manually like this.

Your cash outflows include cash sources like wages, payments to suppliers, bills, advertising, loan payments, and other business expenses

Your cash inflows are likely made up primarily of sales, but could also include things like tax refunds, and money received from grants and from the sale of assets.

Free and Simple Cash Flow Forecast Template

Access a free cash flow spreadsheet template here.

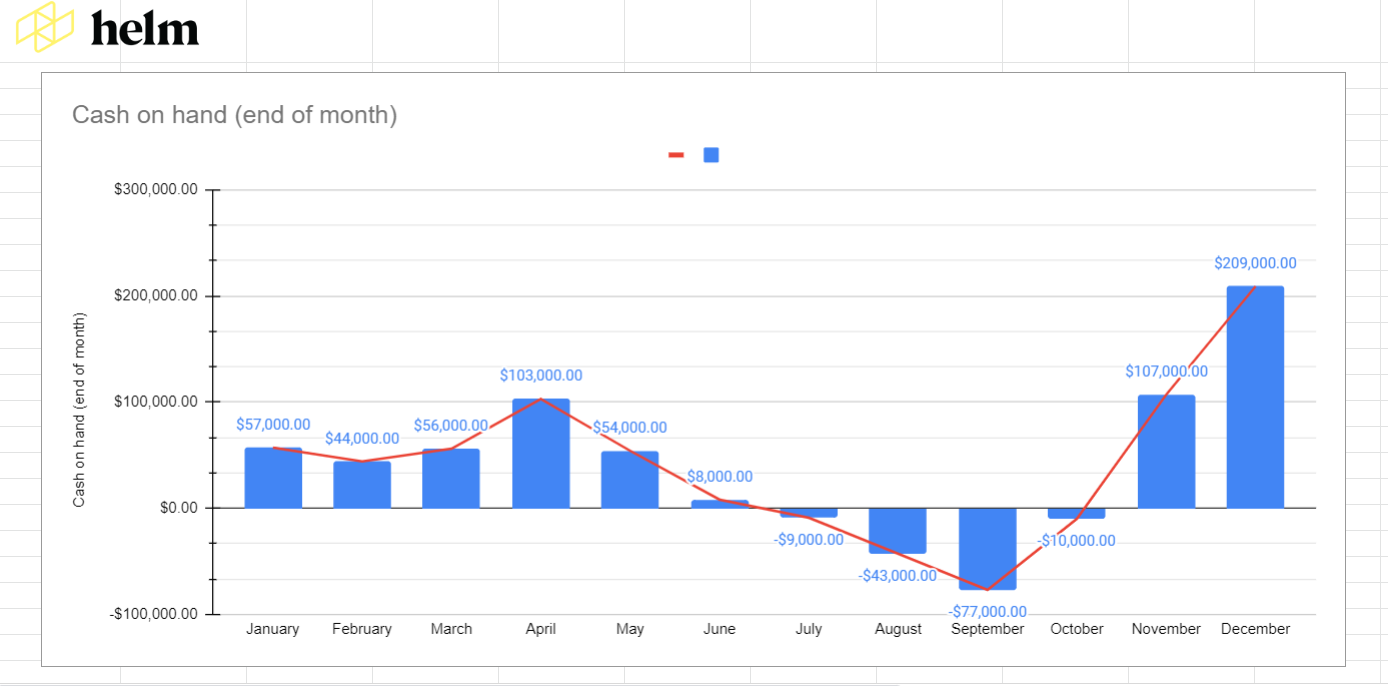

Our template comes with all the formatting and formulas pre-done so all you have to do is enter your expenses and inflows. Using this cash flow projection template you can also view your monthly forecasts and cash balances graphically.

How to Automate Your Monthly Cash Flow Forecast

Even with a template, manually completed forecasts are time-consuming and prone to human error. This is an issue the Helm founders felt firsthand in their business and when talking to clients, and it’s why they built Helm in the first place.

An app like Helm has the ability to automatically sync with your accounting software (Sage, Xero, QuickBooks Online) and generate a cash flow forecast without the need for you to manually source and enter data.

Creating a Cash Flow Forecast in Spreadsheets vs in Helm

Helm syncs with Sage, Xero, and QuickBooks Online and creates a forecast from your data in minutes. That means you save hours of tedious work and you know the data and the forecast is accurate and free from human error, or forgotten accounts.

But Helm isn’t – just – about speed and accuracy. It also provides a whole suite of other benefits like the ability to:

Helm automates cash flow forecasting for small businesses

Test unlimited scenarios side by side to see the impact of multiple different paths your business could take, letting you make the best decisions for your business quickly and confidently (Can you afford a new hire? New equipment? What will inflation add to our costs this year?)

Manage and plan accounts receivable and accounts payable. Letting you do things like preventing overdue payments and see your consistent late payers are.

Pay directly from Helm (greatly simplifying and speeding up your payment process)

Tailor future events to reflect reality. Set when and how frequently events reoccur and adjust growth rates for more accurate and faster planning, compared to adding events one at a time. (No more vague estimates!)

Drag and drop interface making adjustments and collaboration as simple as picking something up and moving it!

See the state of your business and ways you can improve your cash position at a glance with the Helm Health Score Dashboard.

Add unlimited users so collaboration is easy.

Plus you get access to support backed by experience. Helm was designed by accountants and advisors who specialize in offering cash flow forecasts and outsourced controllership services for their clients. They designed Helm to help them work with their small business clients. There isn’t a cash flow question you can ask us we won’t know the answer to.

If you’re interested in seeing Helm in action you can book a book a demo here. Alternatively, feel free to give it a try with a 14 day free trial.