Why do we struggle writing payment request emails?

Asking for payment or money in any scenario can feel awkward – especially when its overdue.

In this article, we’ll take a look at how to effectively and professionally ask for payment on overdue invoices, best practices to follow when sending payment request emails, how to prevent overdue invoices, and example templates for you to implement today.

A peak inside:

(Feel free to jump ahead using the headers below)

6 tips to follow to remain professional and establish an efficient payment process

- Email Templates

Overdue payment reminder email #1 — A week before the payment deadline

Overdue payment reminder email #2 — The day of/ day after the payment due date.

Why you need to request payment from clients

If you’re frustrated with having to request payments you be asking yourself something like

“Why should I even have to bother asking for payment? I provided a service/product they know they have to pay!”

While it can be frustrating there are many legitimate reasons a client may not have paid an invoice – not least of which because they forgot, or it slipped through the cracks.

That’s why its important to send a payment request email.

Perhaps you aren’t frustrated but you feel awkward about asking for payment?

Don’t!

If you provide a service or product clients are actually expecting you to ask for payment. You may even be helping bring to attention late payments that they’ve let slip unintentionally.

The unfortunate reality is most business don’t have an efficient and effective accounts payable and receivable processes.

DYK? 82% of business failures can be attributed to cash management issues.

Preventing late payments before your invoice is overdue

Be sure to send out invoices as early as possible, include all the necessary payment information, and send reminder emails (more on that later).

When sending out an invoice make sure to include:

Specific amount due

The specific payment deadline (avoid potentially ambiguous wording like ‘the coming Friday’, or ‘in 1 month’, and provide the specific payment date.)

The payment terms. Be clear on if payment is do be received all at once, or over a set time period).

Add payment details, i.e. how can your client pay you. (Don’t assume they have this information even if you’ve sent it in the past in a separate document).

Payment instructions. It can be helpful to include a link with instructions on how pay. If a client can’t make a payment easily they may delay it.

Late payment fee (if applicable, this can encourage early payment, but may harm some relationships)

And of course the invoice itself! Sometimes not receiving payment is on us – everybody makes mistakes! Make sure the correct invoice is attached to save yourself future work and some potential embarrassment.

Professionally asking for payment for an overdue invoice

But where are our manners! A request for overdue payments will not only include the necessary information, but have the right tone and structure to be successful.

Here a 6 best practices to keep in mind when writing a payment request email.

Be Clear and Concise

Clearly state the amount owed, the due date, and any other relevant details. Make sure to include all the necessary information to avoid any confusion or misunderstandings.

Use Professional Language

Avoid using slang, abbreviations, or emojis that can be misinterpreted. Use a polite and professional tone, and thank the client for their business.

Follow Up Promptly

If a client is late on a payment, reach out to them as soon as possible to avoid any further delays. A gentle reminder can often be enough to prompt them to make the payment.

Provide Payment Options

Providing payment options can make it easier for clients to make their payments. Include all the available payment options, such as credit cards, PayPal, wire transfers, and checks. Make sure to provide clear instructions on how to make the payment and include any necessary account information.

Offer Payment Plans

Offering payment plans can be an excellent option for clients who are struggling to make the payment in full. You can offer a flexible payment plan that allows them to pay in installments over a set period. Make sure to set clear terms and conditions for the payment plan and communicate them clearly to the client.

Be Firm but Polite

Don’t assume they are neglecting payment intentionally. You want to make sure that the client understands the seriousness of the situation, while avoiding being aggressive or confrontational. Use a polite, but firm, tone to communicate your message effectively.

Payment request email templates

Below you’ll find 5 example emails to ask for payment professionally. Don’t be afraid to tailor the content and timing. You may also want to reference information from past replies, but don’t waste time over personalizing them.

Be sure to also attach any necessary documents or information needed.

And remember you know your clients and their preferences best.

Would your clients be annoyed or appreciative if you sent them a reminder day of? Would they find one week notice helpful, or would an earlier reminder be more beneficial?

Only you can answer questions like these, and if you can’t, don’t sweat it. But don’t be afraid to ask for payment. If you follow the guidelines we’ve discussed above you’ll set yourself up for success!

Payment request email #1 — A week before the payment deadline

Goal and key notes: A week out we want to encourage early, or on time payment, while being informative and friendly.

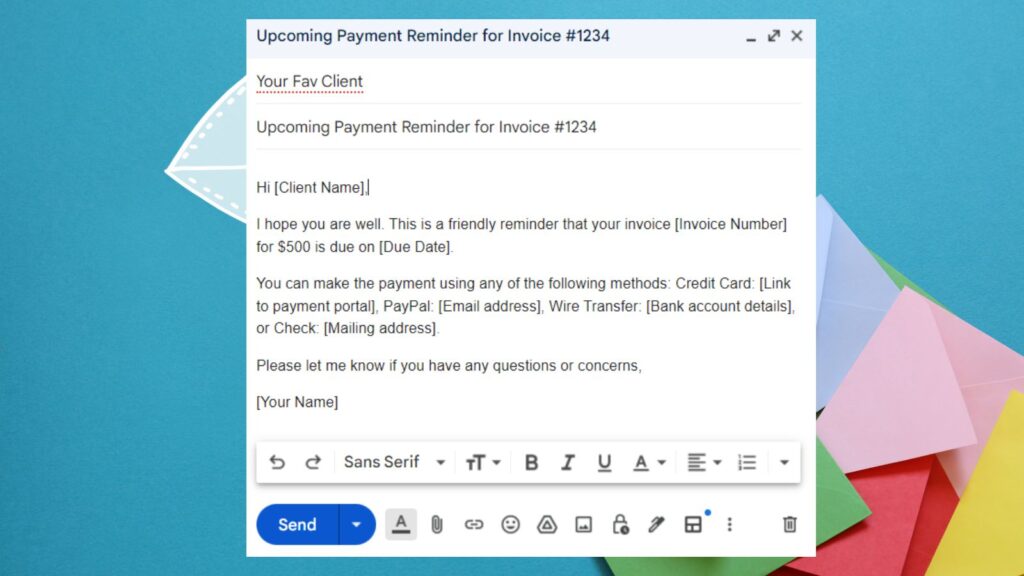

Subject: Upcoming Payment Reminder for Invoice [#1234]

Hi [Client Name],

I hope you are well. This is a friendly reminder that your invoice [Invoice Number] for $500 is due on [Due Date].

You can make the payment using any of the following methods: Credit Card: [Link to payment portal], PayPal: [Email address], Wire Transfer: [Bank account details], or Check: [Mailing address].

Please let me know if you have any questions or concerns,

[Your Name]

Payment request email #2 – Payment reminder email template for a day overdue or day of

Goal and key notes: While still being friendly we want to stress our call to action, and make it clear payment is now due.

Subject: Urgent Payment Reminder for Invoice [#1234]

Hi [Client Name],

I hope this email finds you well. Just a reminder that the payment for the invoice [Insert Invoice Number] is due today, [Insert Due Date]. Unfortunately, our records indicate that we have not received the payment from you yet.

In case you have already made the payment, kindly ignore this reminder.

You can make the payment to bank account listed on the invoice attached.

Please let me know if you have any questions or concerns,

[Your Name]

Payment request email #3 — A week late

Goal and key notes: If you haven’t heard from the client in a week you can send another reminder. As the invoice is now past due we should use a firmer tone. However, don’t assume the client is intentionally neglecting payment, and never make things personal.

Subject: Payment One Week Overdue | Invoice #1234

Hi [Client Name],

According to our records we have not received payment for Invoice #1234. As a reminder, the total amount due on the invoice is [Invoice Amount], and the payment was due on [Due Date].

If there are any issues with the invoice or payment that we can assist with, please let us know so we can work together to resolve them as soon as possible.

Thank you for your prompt attention to this matter. If you have any questions or concerns, please do not hesitate to contact us.

If you’ve already made the payment, please kindly ignore this email.

Sincerely,

[Your Name]

Payment request email #4 — Two weeks late

Goal and key notes: After two weeks we want to emphasize that payment is overdue, and be clear and direct. We also want to confirm that the client has received the email.

Subject: Payment Two Weeks Overdue Invoice #1234

Hi [Client Name],

I am writing to follow up on the payment of Invoice #1234

The total amount due on the invoice is [Invoice Amount], and the payment was due two weeks ago on [Due Date].

We would appreciate it if you could provide us with an update on the status of the payment within the next [number of days] days.

Please reply to this email to let me know you have received it.

Best regards,

[Your Name]

Payment request email #5 — One month late

Goal and key notes: By this point we have sent the client multiple reminders and the invoice is now 1 month overdue. Remain professional, but use a clear and firm tone. You may also want to reference your payment terms, and any late payment fees applicable.

Subject: Payment 1 Month Overdue Invoice #1234

Hi [Client Name],

This another reminder for payment of Invoice #1234 totaling [Payment Amount] which is now 30 days past due.

Please be aware, that if payment is not received today, you’ll be charged a payment fee of [late fee %] as per the payment terms.

If you have any questions please reach out. Otherwise, please make the payment immediately.

[Your Name]

How to handle outstanding invoices (30-90 days late)

Send further reminder emails at 60 and 90 days.

After 30 days the outstanding payment is considerably late and you shouldn’t be afraid to say so. Remain polite and professional. You want to preserve future business relationships with this client and others, but you may consider revocation of products or services, if possible, until payment is received.

After 90 days, it becomes increasingly unlikely that you’ll be able to collect overdue payments. You should plan as if you will not receive these payments.

You may also wish to pursue legal action at this point.

If this client orders regularly from you, you may wish to block any future orders until payment is received.

We hope you found these tips and templates helpful. If your interested in seeing how Helm can help improve your accounts payable and receivable process and planning you can learn more here.

Until next time!