In this article, we’ll look at what Float Cash Flow is, as well as 4 alternatives for small businesses looking to do cash flow forecasting.

What is Float Cash Flow?

Float cash flow is cash flow forecasting and scenario planning software targeted to businesses, accountants, and bookkeepers. Float was to designed to save time and help business determine how much cash they’re going to have in the future and make better decisions.

Some key features include:

- 3 year future cash flow forecast

- Ability to test scenarios

- Weekly cash summary

- Export forecast to CSV & PDF

- Budgeting/Budget vs actual reporting

- Cash flow management (Manage invoice & bills)

- Email support

Float Cash Flow integrates with Xero, QuickBooks online and FreeAgent

How much does Float Cash Flow cost?

USD $ 59-249 per month/per business

Float offers 3 pricing plans: Essential, Premium and Enterprise. You have the option to be billed monthly or annually for a discount.

What training & support does Float Cash Flow offer?

Under the Essential plan Float offers an initial set-up call with a Float cash flow expert, email support, and access to their support site and tutorials.

The Premium plan adds the option for a quarterly review call with a Float cash flow expert.

While the Essential plan adds a dedicated account manager, and a monthly review of your forecast with a Float cash flow expert.

4 Float Cash Flow alternatives for small businesses

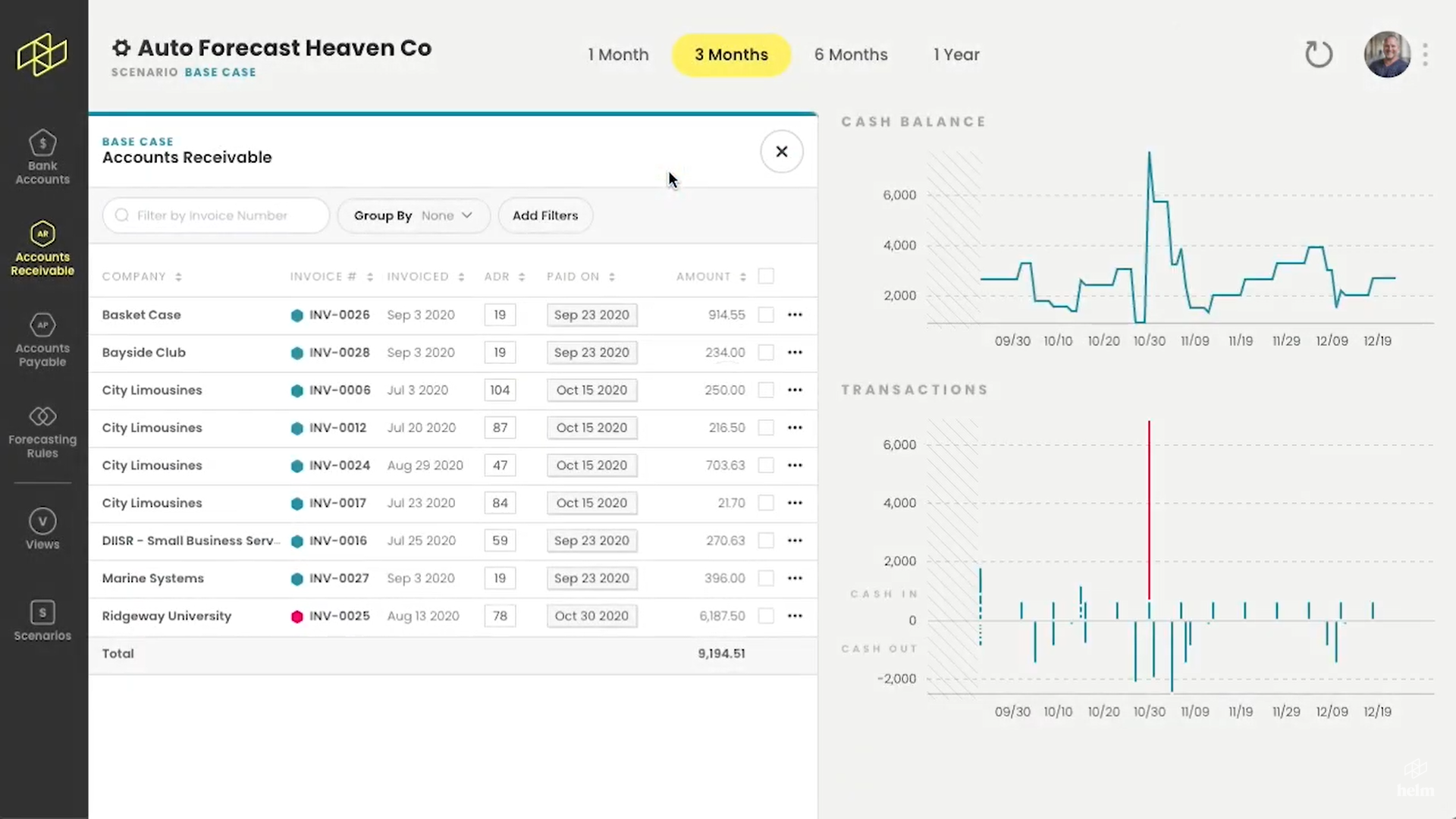

1. Helm cash flow forecasting

Designed by accountants and small business advisors, Helm lets you see your future cash position in real-time, so you can make confident business decisions without wasting hours in spreadsheets.

Some key features include:

Provides 1-month, 3-month, 6-month and 12-month forecasting with various viewing options

Let’s you test unlimited scenarios side-by-side

Analyses the historic transaction data of each contact to predict how you will be paid in the future

Financial health dashboard with key business and cash flow metrics

Manage accounts payable and receivable

Drag and drop visual interface for quick, easy collaboration

Ability to execute your payment plans directly from Helm through Veem

Helm integrates with: QuickBooks Online, Xero, Sage and Veem.

How much does Helm cost?

USD $ 32-49 per month/per business

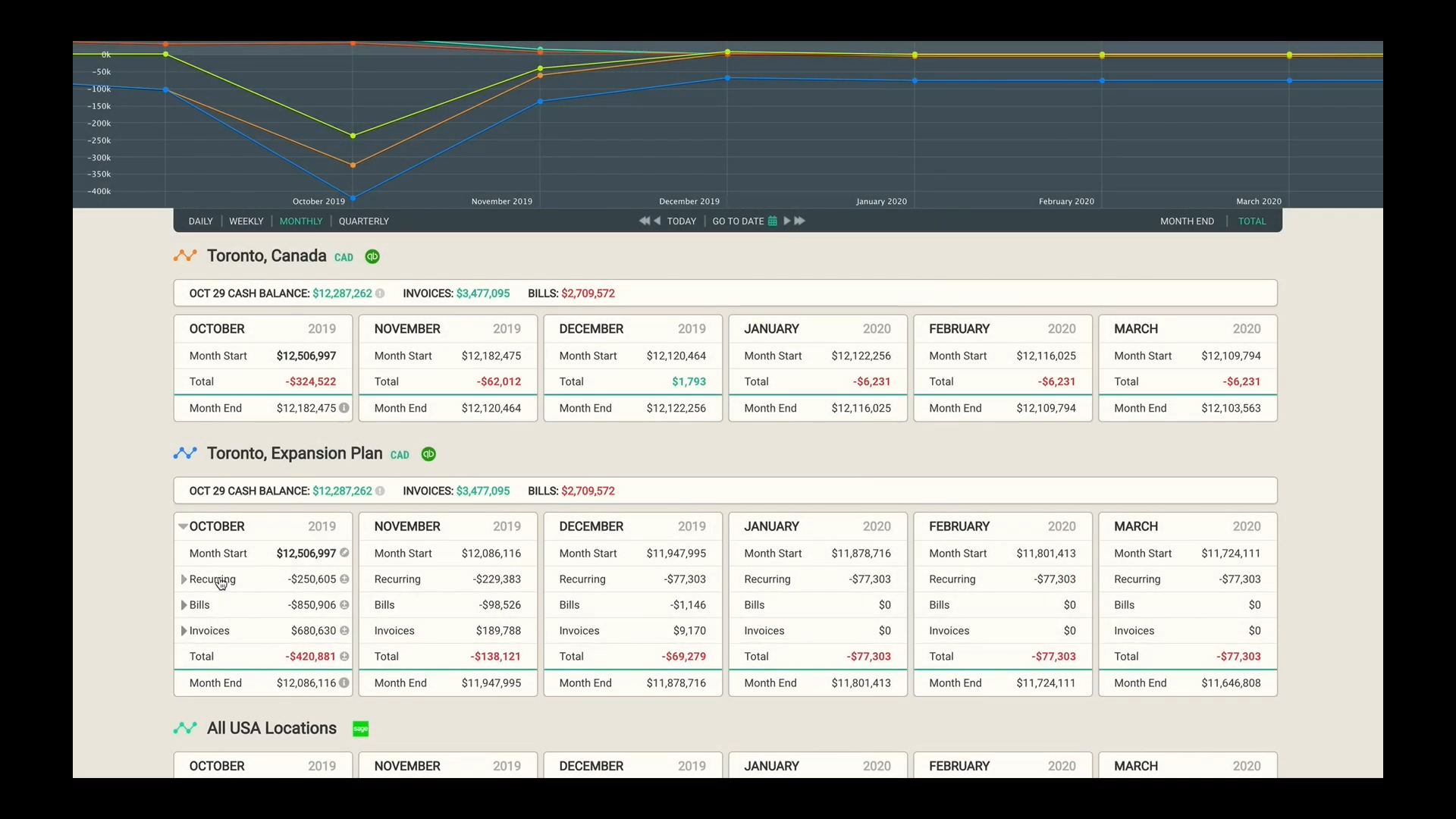

2. Dryrun

Dryrun provides an automated, cloud-based solution for cash management, financial modeling, and business forecasts.

Some key features include:

Unlimited forecasts & scenarios

Auto forecast capability

Consolidate scenarios

Weekly action reports

Live currency conversion

Dryrun integrates with: QuickBooks Online, Xero, QuickBooks Desktop, Sage Accounting, and Pipedrive

How much does Dryrun Cost?

USD $ 200-400 per month/ per business

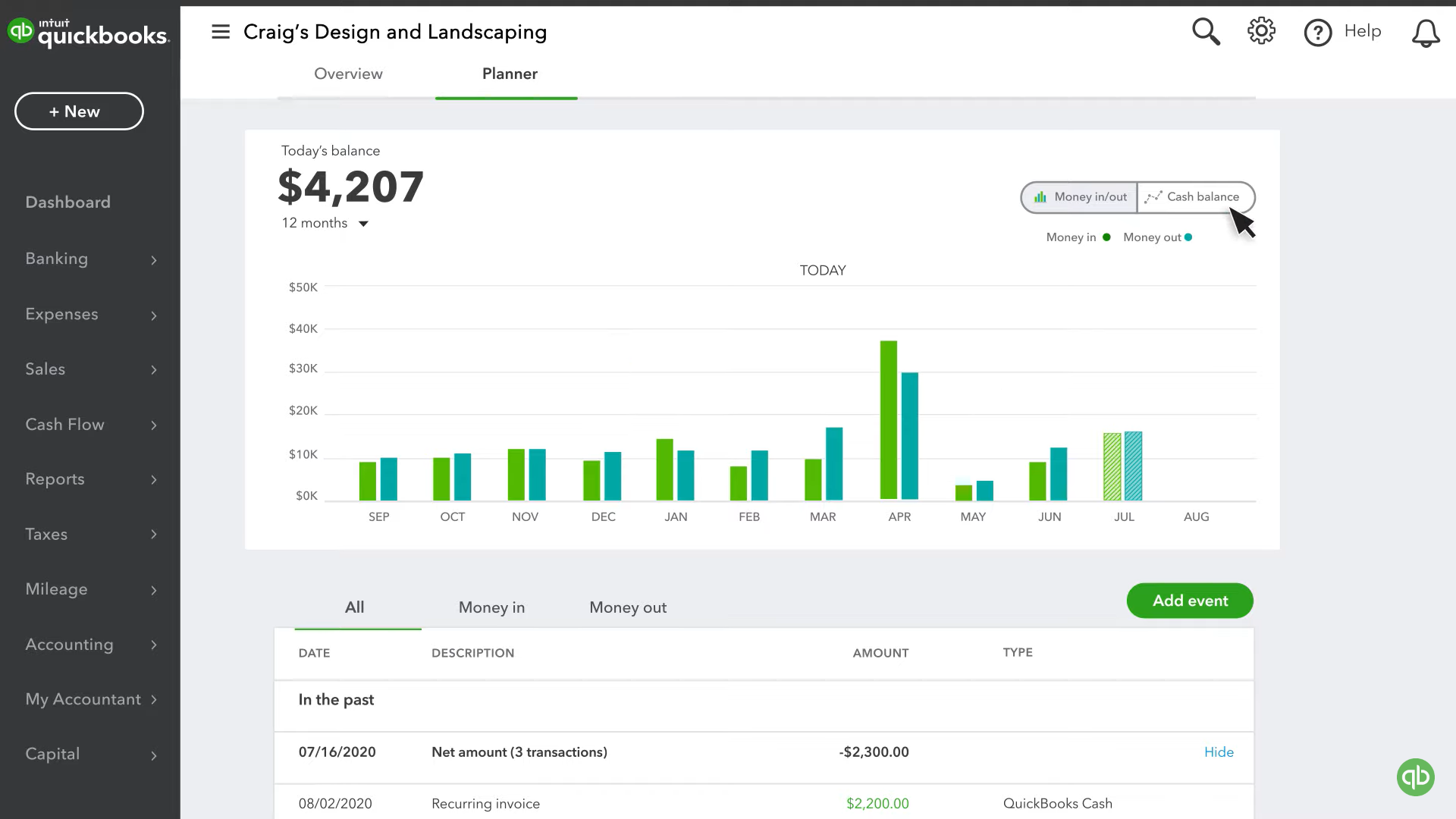

3. QuickBooks online cash flow forecasting

QuickBooks Online offers a built-in cash flow tool free to their users. For QBO users and newcomers to cash flow management it acts as a great starting point.

Check out our guide on how to use QBO’s cash flow tool.

Some key features include:

Creates forecasts for up to the next 12 months

Lets you view all your upcoming transactions

Includes basic scenario planning

Included with subscription to QBO

How much does QuickBooks Online’s tool cost?

Included with your subscription to QuickBooks online.

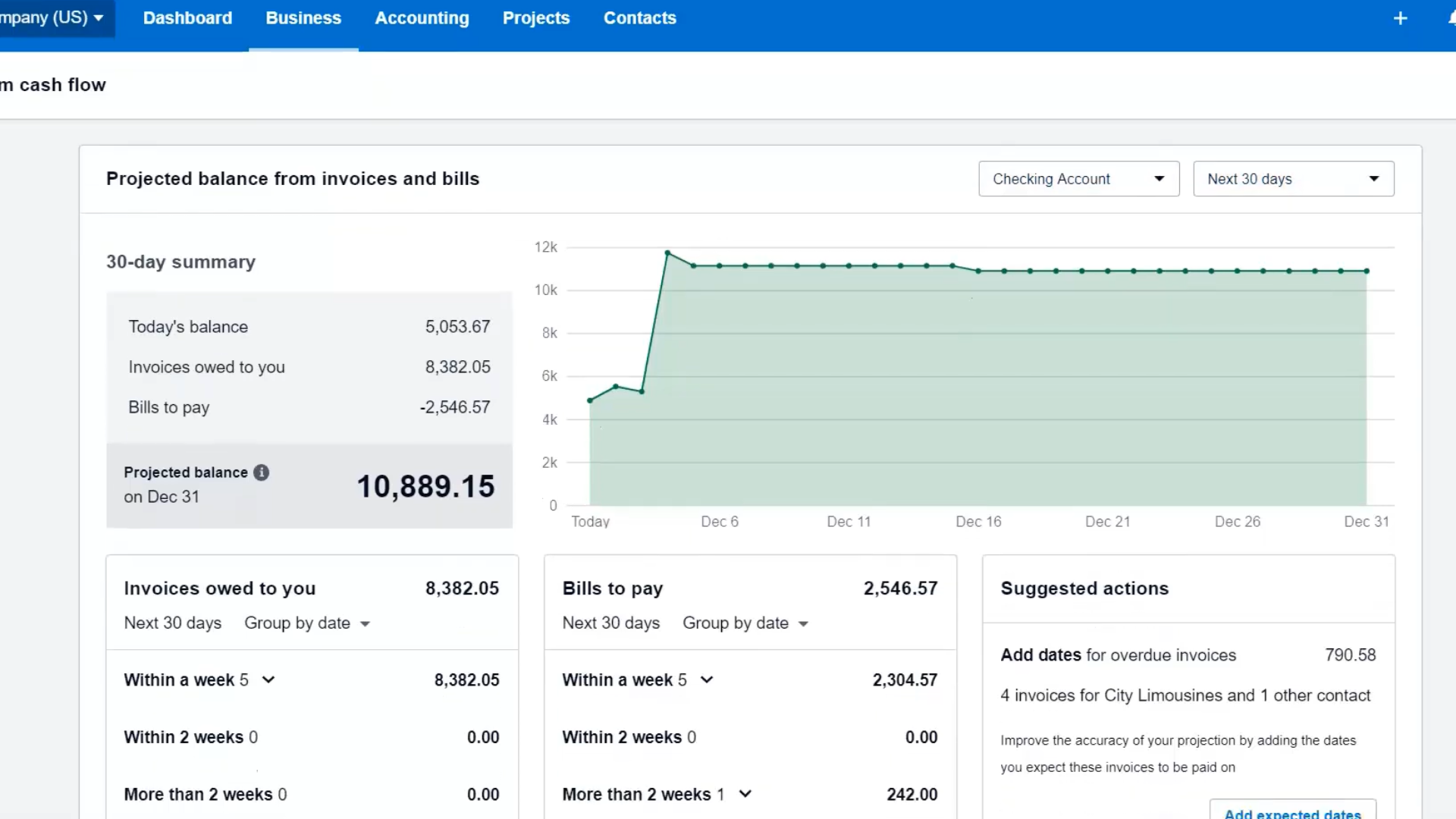

4. Xero cash flow forecasting

Are you a Xero user looking for a simple forecasting tool? Xero’s built in tool can be a great starting place. Best of all it comes free with all levels of your Xero subscription!

Check out our guide on how to use Xero’s cash flow tool.

Some key features include:

Offers simple 7-day and 30-day cash flow reporting

Allows yo to see upcoming invoices and bills to paid and your projected cash balance

Best suited for very short term cash flow

Included with subscription to Xero

How much does Xero’s cash flow tool cost?

Included with subscription to Xero.

Looking for more Options?

Looking for more options? Check out our list of the 10 best cash flow apps for small business.

If you’d like to see if Helm is right for your business book a discovery call or learn more here.

Until next time!