In this guide, we’ll start with the basics of what cash flow and cash flow forecasting are, why they’re important for businesses, and how you can get a free template to start forecasting today.

Already got the basics covered? Feel free to jump ahead using the linked headers below:

What is cash flow?

If you search cash flow on Wikipedia you’ll find a bunch of information on liquidity, profits, accounting standards, and more. All that is great, but it overcomplicates things.

In the most basic sense, cash flow is simply the amount of money that flows into and out of a business.

Credit where it’s due, Investopedia probably has the most concise definition of cash flow we have seen. The writer, Adam Hayes, does a great job of summarizing it at a basic level:

“Cash flows are the net amount of cash and cash-equivalents being transferred into and out of a business. Cash received are inflows, and money spent are outflows.”

He furthers this by stating that:

“At a fundamental level, a company’s ability to create value for shareholders is determined by its ability to generate positive cash flows.”

No need to overcomplicate it. Cash flow is simply the amount of money that flows into and out of a business.

What is a cash flow forecast?

A cash flow forecast plans out a business’s cash flow (or inflows and outflows of cash/money) for a given period of time. Cash flow forecasts can be created for the short or long term.

The goal of any cash flow forecast is to give information on when you’ll have a surplus or a lull of cash, so you can make informed decisions for your business. Cash forecasting is especially important for small businesses, businesses with seasonal fluctuations, businesses with ‘lumpy’ payments, and any business where cash flow is inconsistent.

A short-term cash flow forecast can be defined as anything from a one-week forecast to 30 days, 90 days, or even a year into the future. Looking at the immediate future gives you more confidence to make decisions about your business.

On the other hand, a medium or long-term cash flow forecast looks 2 to 5+ years out, and is typically measured in quarterly or yearly increments.

In this article, we’re gonna focus on how to build a 1-year forecast reporting cash balances on a monthly basis. A 1-year forecast helps you see any potential short-term gaps as well as make plans for the future.

Creating Cash Flow Forecasts

Creating a cash flow forecast can seem like a daunting task at first. But, by keeping your books in order and using a template you can simplify the process (apps can also help, but more on that later!).

To create a cash flow forecast you’ll need to gather all the information on cash inflows and cash outflows of cash during a period (monthly in our case). You’ll also need your bank balance amount and any other sources of income, like a line of credit, to serve as your starting cash position. You’ll then take all this information and put it in a spreadsheet where you can calculate your cash flow each month.

If you read the above and thought to yourself “that’s gonna take a while”, you’re not alone in your thoughts, so let’s see some ways we can speed things up.

First up – templates.

What is a cash flow forecasting template?

Exactly what it sounds like. The theme of the day is don’t overcomplicate things where you don’t have to. A cash flow forecast template is a preset template in a spreadsheet that you can use time and time again. No sense in reinventing the wheel. After all, the goal of a cash flow forecast is to help you make better business decisions – not spend more time in spreadsheets.

Why use forecast templates?

They save time, money, and prevent gray hairs (they simplify the process).

What more is there to say?

How to create your own cash flow forecast template?

Creating a cash flow forecast is relatively simple, all you need is access to spreadsheet software like excel or google sheets. There are also lots of free templates online (including ours below) that you can use and quickly tailor to your own needs.

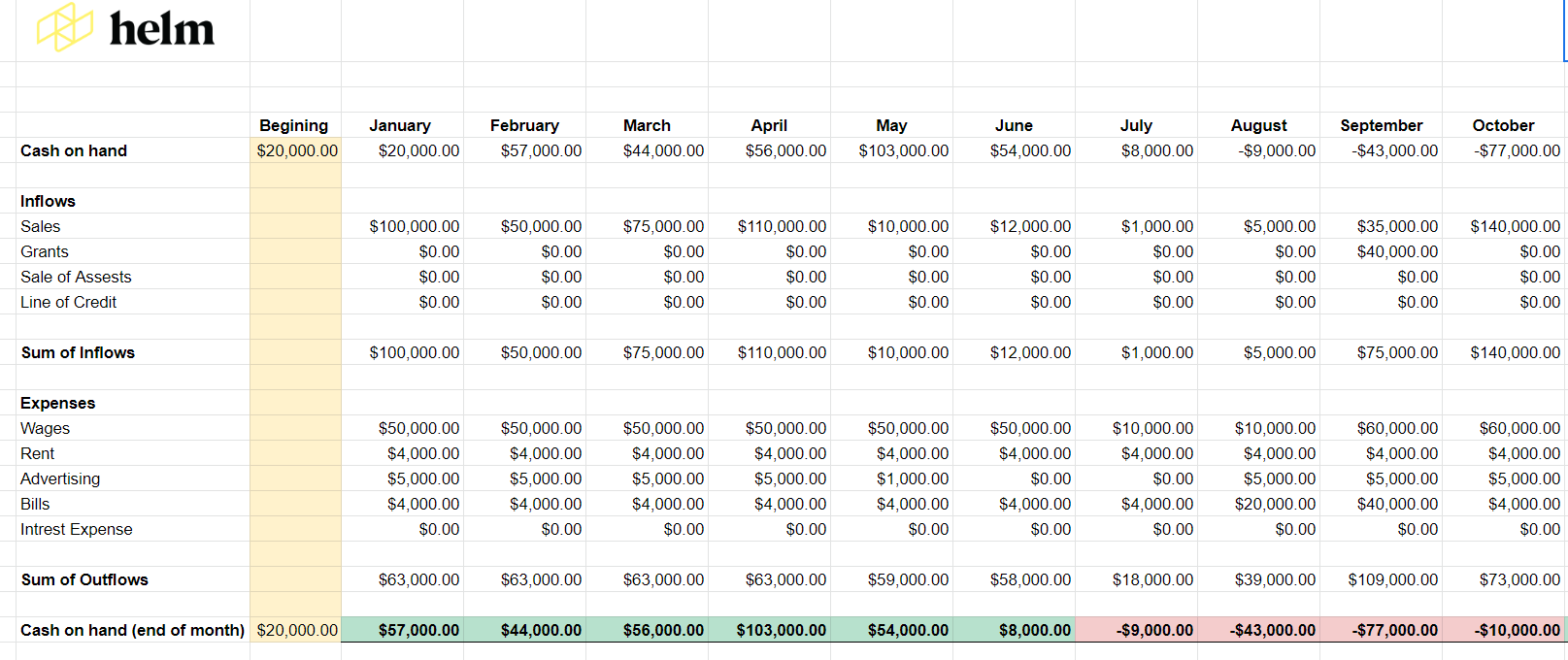

At the very minimum you’ll need columns for each time period you want to predict your cash balance, and rows underneath for inflows and outflows. It’s up to you how detailed you make the forecast, often this comes down to a tradeoff between time and accuracy when you’re forecasting manually like this.

Your cash outflows include cash sources like wages, payments to suppliers, bills, advertising, loan payments, and other business expenses

Your cash inflows are likely made up primarily of sales, but could also include things like tax refunds, and money received from grants and from the sale of assets.

Free & simple cash flow forecast template

Access a free cash flow spreadsheet template here.

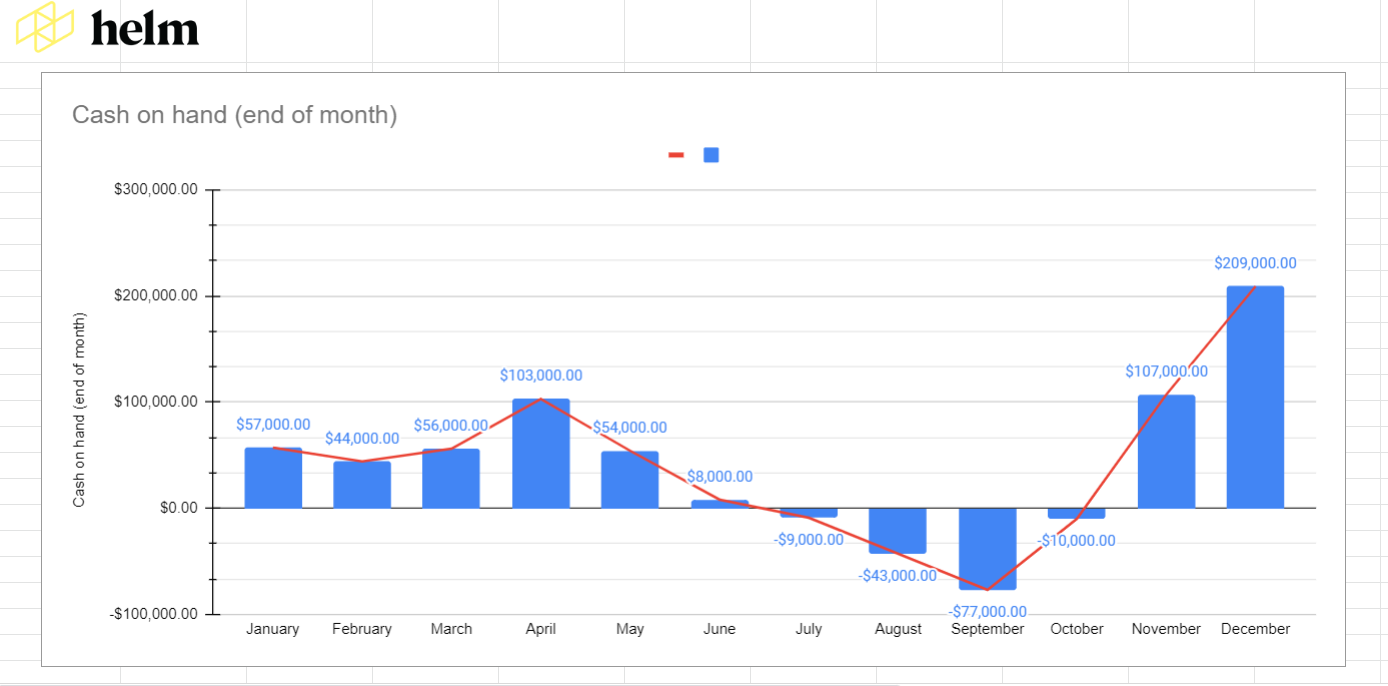

Our template comes with all the formatting and formulas pre-done so all you have to do is enter your expenses and inflows. Using this cash flow projection template you can also view your monthly forecasts and cash balances graphically.

How to automate your monthly cash flow forecast

Even with a template, manually completed forecasts are time-consuming and prone to human error. This is an issue the Helm founders felt firsthand in their business and when talking to clients, and it’s why they built Helm in the first place.

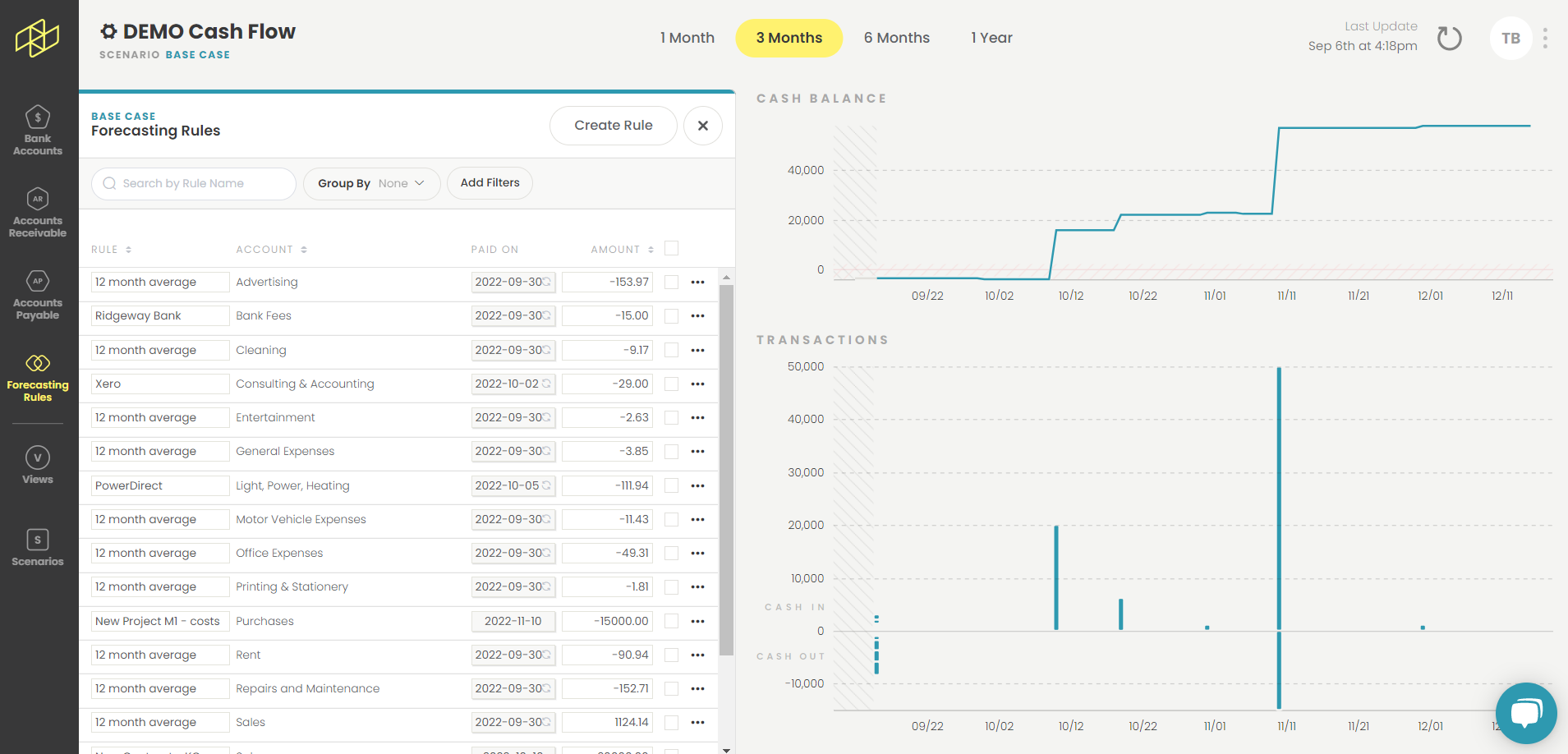

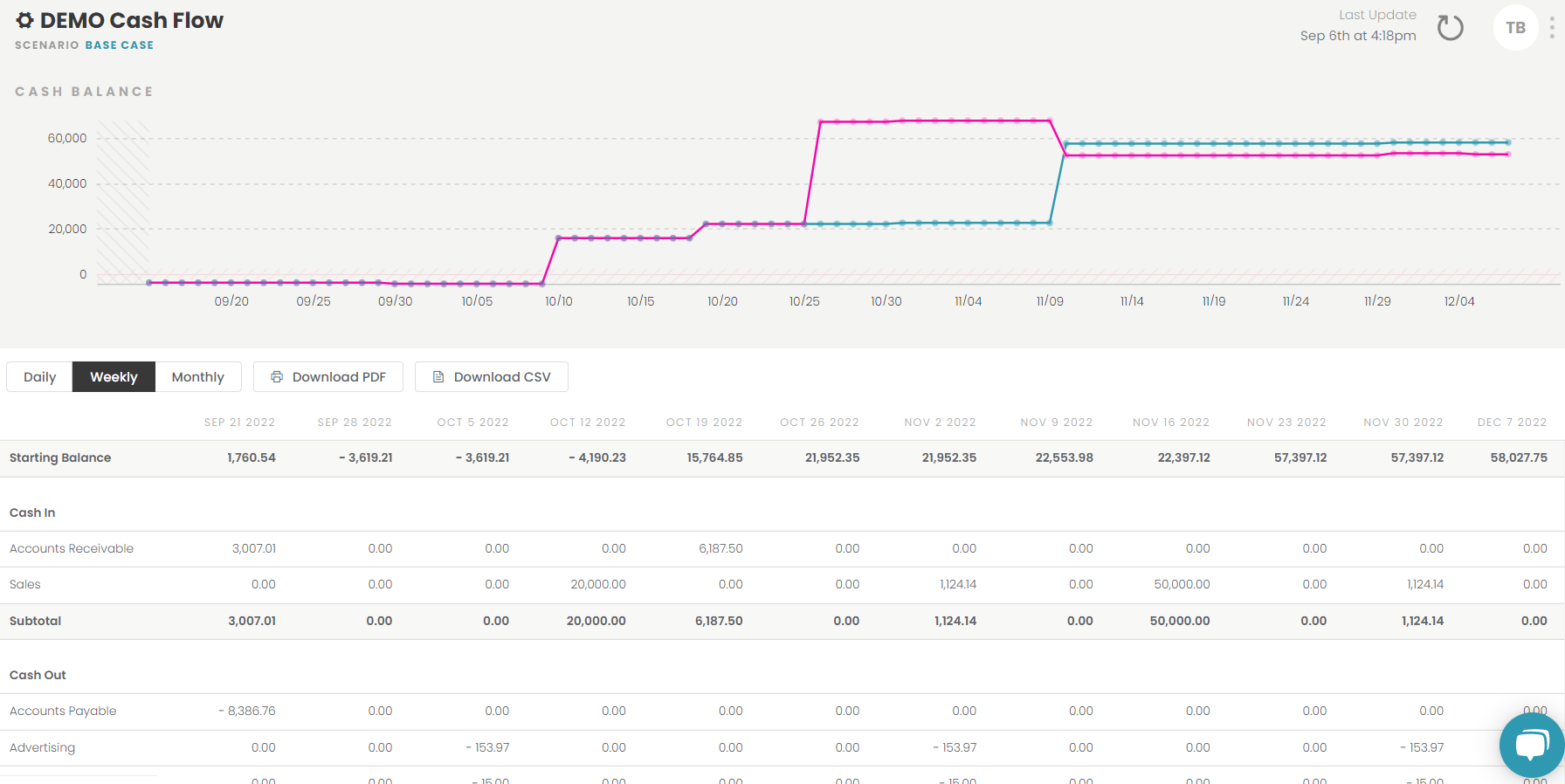

An app like Helm has the ability to automatically sync with your accounting software (Sage, Xero, QuickBooks Online) and generate a cash flow forecast without the need for you to manually source and enter data.

Helm vs. Spreadsheets for cash flow forecasts

Helm syncs with Sage, Xero, and QuickBooks Online and creates a forecast from your data in minutes. That means you save hours of tedious work and you know the data and the forecast is accurate and free from human error, or forgotten accounts.

But Helm isn’t – just – about speed and accuracy. It also provides a whole suite of other benefits like the ability to:

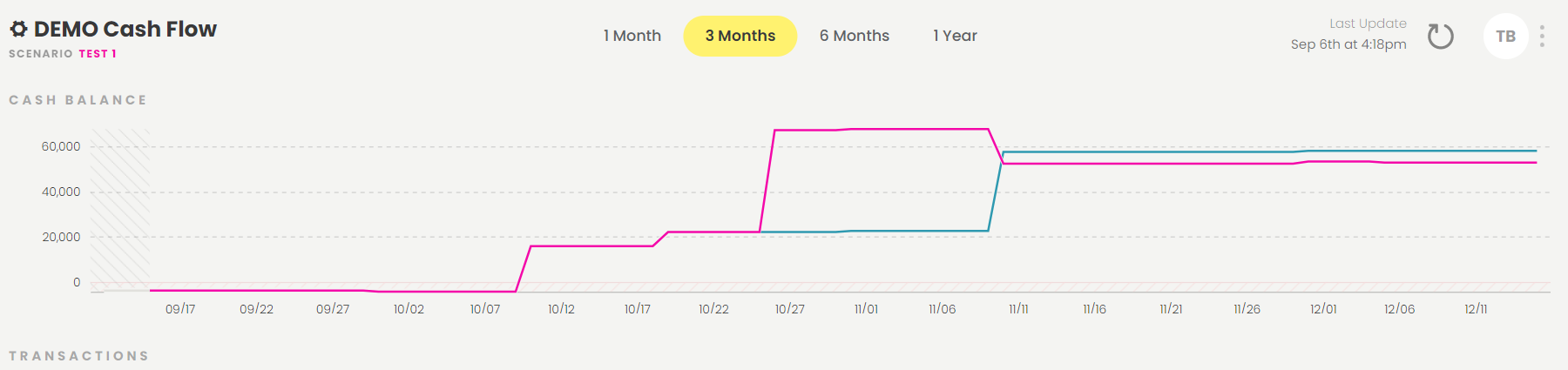

Test unlimited scenarios side by side to see the impact of multiple different paths your business could take, letting you make the best decisions for your business quickly and confidently (Can you afford a new hire? New equipment? What will inflation add to our costs this year?)

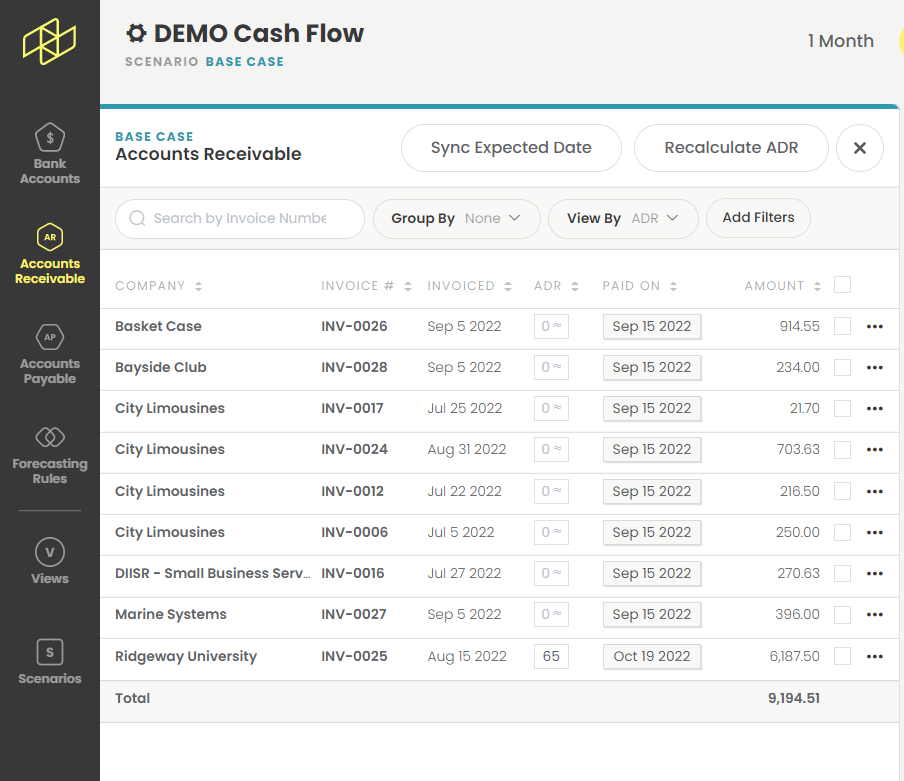

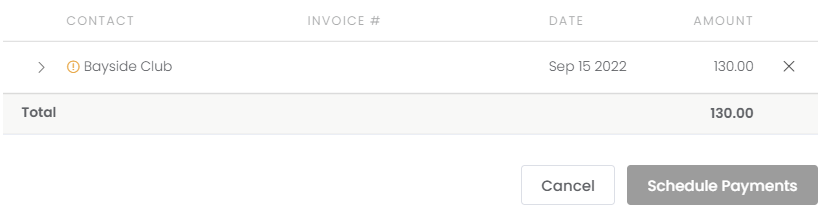

Manage and plan accounts receivable and accounts payable.

Pay directly from Helm (greatly simplifying and speeding up your payment process)

Tailor future events to reflect reality. Set when and how frequently events reoccur and adjust growth rates for more accurate and faster planning, compared to adding events one at a time. (No more vague estimates!)

Drag and drop interface making adjustments and collaboration as simple as picking something up and moving it!

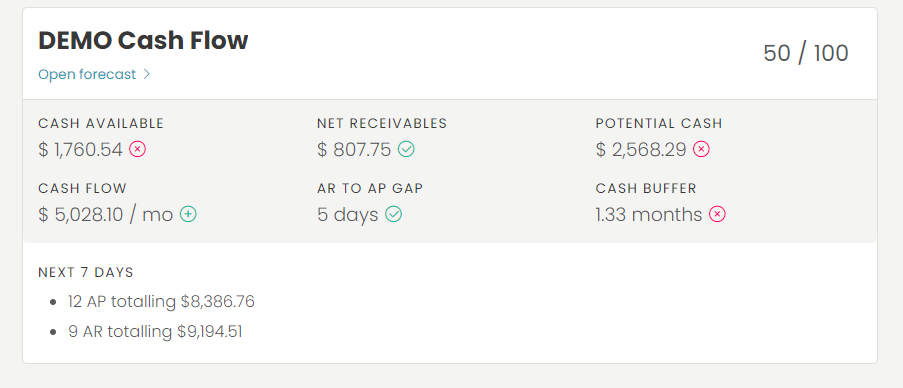

See the state of your business and ways you can improve your cash position at a glance with the Helm Health Score Dashboard.

Add unlimited users so collaboration is easy.

Plus you get access to support backed by experience. Helm was designed by accountants and advisors who specialize in offering cash flow forecasts and outsourced controllership services for their clients. They designed Helm to help them work with their small business clients. There isn’t a cash flow question you can ask us we won’t know the answer to.