Today we’ll be looking at the average price and costs of fractional CFOs to help you price your services.

A peak inside:

What is Fractional CFO?

First up lets cover some jargon and clear up any misconceptions.

You may see Fractional CFOs go by many names including: outsourced controller, external controller, part-time CFO, and of course fractional CFO.

You may also simply see financial professionals market the actual services they provide, without referring to the any of these job titles. In a “services we offer” section of their website you may see things like ‘forecasting and cash management’ or strategic financial planning’.

All of these are usually referring to essentially the same services. The difference just comes down to how individuals and firms decided to market their services, and a general lack of agreement on what to call these services.

These days we most commonly see the ‘Fractional CFO’ title used for marketing purposes, while internally many accounting professionals still refer to these as controller services.

For more read: The difference between bookkeepers, controllers and CFOs.

So what are those services anyway?

What Does a Fractional CFO do?

Whatever they call themselves, the role of Fractional CFOs includes:

Overseeing the bookkeeping process

Creating and managing budgets

Creating and managing cash flow forecasts

Creating custom financial models and financial reports

Selecting and maintaining financial software

Analyzing financial statements and data

How much should I charge for CFO services?

Fractional CFO’s typically charge between $200-350/hour which is about $2000 – $14500/month, or $24,000-174,000/year. Pay varies by the amount of work, type of work, duration, experience, and industry knowledge of the fractional CFO.

How Much Does a Fractional CFO Cost?

If you’re currently doing something like bookkeeping, where commoditization has driven hourly rates as low as $20/hour (yikes!) this may sound like a lot. But in context it’s actually a big savings for small businesses.

For reference the average full time CFO makes $145,016 in the US, and $127,597 in Canada, in base salary. An experienced CFO will also expect benefits including medical coverage, profit sharing, and bonuses. This easily pushes the total cost of hiring a CFO over $150,000/year, and often much closer to $200,000.

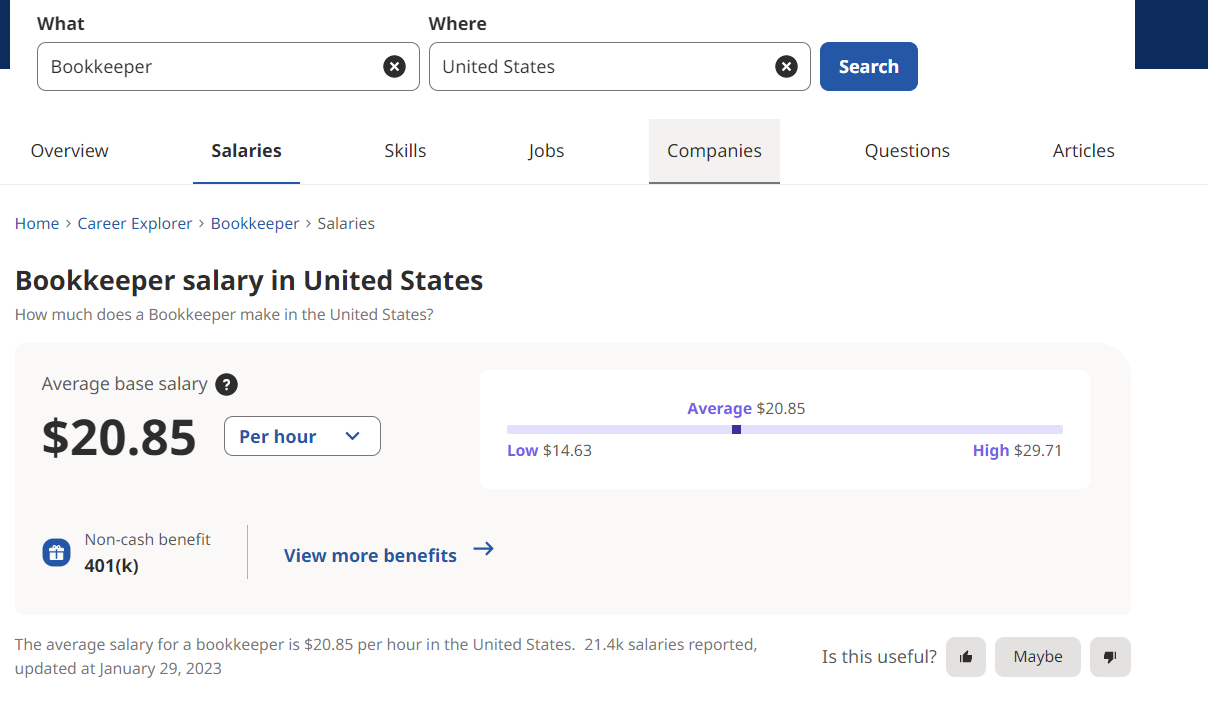

Below: screenshots from Indeed, showing average CFO salaries in 2023.

Canada:

United States:

Hiring a full time CFO is therefore usually impossible for small business due to the costs (they also probably don’t need someone on a full time basis yet).

Fractional CFO costs are much lower. If a business were to hire a fractional CFO for 20 hours/month at an hourly rate of $250 this world cost them $60,000/year.

Put another way they would save about $90,000/year ($150,000-60,000) compared to hiring a full time in house CFO.

The bottom line here is: don’t be afraid to get paid for the valuable work you do! Fractional CFO services represent strong value for advisors and small businesses.

How many hours does a fractional CFO work?

Another perk of outsourced CFO services is they can work as much or as little as they like. This provides flexibility for businesses as they scale their services, as well as giving freedom to the financial advisor.

Typically, fractional CFOs work with multiple clients throughout a regular 40 hour work week. The more efficiently they can work with each client, the higher the benefit and ROI for all parties involved.

Note: Good bookkeeping data is essential for proper fractional CFO work, when establishing your service plan devote a significant amount of time to nailing the fundamentals as they will continually pay divides for you and your client.

As we saw, a big part of outsourced CFO service is managing cash and creating things like budgets and cash flow forecasts, where garbage in = garbage out. For your forecasts and budgets to be accurate you need reliable data.

Check out our guide to transitioning your services to controllership/fractional CFO for more on this.

ROI for Fractional CFO Work

All this talk about prices and costs probably has you thinking ‘that sounds great, but how long will it take?’

AKA is it worth it?!?

Short answer YES. Both financially and in terms of personal and professional fulfillment.

Let’s start with financially. Once the bookkeeping process is running smoothly, creating budgets, cash flow forecasts, and managing receivables and payables may sound like a big time investment, but with the right tools it can be a quick and easy process.

We’re going to use Helm as an example here, but check out our list of top 10 cash management apps for more options.

ROI breakdown:

Earlier we saw the average price for fractional CFO was in the range of $200-350/hour.

To emphasize that there is significant ROI even for new or unexperienced fractional CFOs, we’ll use the low end of this range for our calculations, and to simplify calculations we’ll use the example of a cash flow forecast as a tangible deliverable for clients.

With automated forecasting in Helm you can create a cash flow forecast in seconds, but you also have the ability to tailor your forecasts as much as you like and test unlimited scenarios side-by-side. So, let’s assume you spend a couple hours a month tailoring your forecast and testing scenarios as you respond to client queries.

Up to now, you’ve done a couple hours of work and were able to deliver a tangible and valuable service to your client. If you were charging an hourly rate (which we don’t recommend, more on that below) at the low end of typical costs you would charge this client $400 (2hours * $200/hour).

Your investment would be 2 hours of your time, and $32 for Helm.

We can also include the opportunity cost of you doing other work, like bookkeeping. If we check Indeed again for average wage for a bookkeeper we see it is $20.85 in the US. So the opportunity cost for a bookkeeper would be 2hours * $20.85 = $41.70

Now we can calculate our return on investment:

ROI = [Net Income/ Initial Investment] *100

= [[$400 – ($32 + $41.70)]/$32 + $41.70] * 100

= [326.30/73.70] *100

ROI= 442.7%

While this is only for one specific task, hopefully you can see that even when using a pricing model we don’t recommend (hourly rate) the return you’re seeing is significant.

The client also receives substantial value – read our article on why cash flow forecasts are important for business for more.

Fulfilling work:

Before we discuss our recommend pricing structure, it’s valuable to point out the less numeric or financial benefits.

Many bookkeepers and tax advisors we’ve spoken to who where feeling burnt out, commoditized, or just simply run down by the daily grind have found a lot of relief in controller services.

While it won’t be to everyone’s tastes, controller work offers advisors a way to have more input on the financial growth of their clients’ businesses, and do less repetitive work.

As we highlight in our 12-month guide to start offering controller services, communication plays a big role in controllership which may not be for everyone, but if it is right for you, it can be extremely rewarding!

The Best Pricing Structure for Part Time CFO service (Hourly rate, fixed, monthly rate, value-based, cost-based?)

Pricing for just about anything is always a contentious topic, but perhaps especially so for financial services and among various types of advisors.

There is no silver bullet here, and what works for one advisor and their set of clients may not work elsewhere.

We’ve asked Helm Co-Founder, Kelvin Gieck to share how he prices their services at his firm Twenty-Eighty Financial, which specializes in fractional CFO work for small businesses.

“At Twenty-Eighty all our clients pay an agreed upon flat rate upfront – no exceptions. This allows our pricing to cover our costs, and encapsulate the value of the services we provide. It also helps us set clear definitions for the work to be done for our team, and prevent scope creep. For our clients, it gives them a very clear picture of what they’ll be getting from their investment and what they can expect from day 1.”

– Kelvin Gieck, Helm Co-Founder

Join the discussion in the mastering controllership group.

Until next time!