In this article, you’ll find a brief guide to some key cash management concepts, and a list of some the best cash flow management software on the market.

What is Cash Flow Management and Forecasting

First up, what is cash flow management and cash flow management software?

The short answer is cash flow management refers to process of managing cash in and flows through a business. For a deeper look, read our full article on what cash flow management is and why its important for small businesses here.

Cash flow management software

Cash flow management software aims to improve this process and help business owners track their transactions, manage payments/bills and plan for the future.

A closely related term is ‘Cash flow forecasting‘, which refers to predicting future cash flows and planning for future events.

When apps and software refer to cash flow forecasting it usually means their software has more emphasis on the planning aspect of cash flows and less on management.

Although you’ll find there is lots of overlap in features and use of terminology, so you’ll want to check each software’s feature set (more on that below)

The bottom line is, good cash management and forecasting helps businesses make better financial and operational decisions.

Cash flow management software augments these processes by saving time, eliminating tedious work, and improving accuracy.

What are some of the common features of cash flow management tools?

Here are some key common features you should watch for when looking for cash flow management software.

Software Integration

A big way that cash flow management software helps is by eliminating the data gathering and verifying steps in the cash management process. This is usually done by integrating with your accounting software to pull data directly ensuring accuracy and speed.

No matter the accounting software you’re using (Quickbooks Online, Xero, Sage, ect…), you’ll want to check to make sure the software you choose has the ability to synch with your system.

Cloud based

To avoid being tied down to specific computers, or if you know you’ll be collaborating and sharing report results keep an eye out for cloud based solutions.

Cloud based systems have the advantage of giving you more freedom, and make collaborating with stakeholders easier.

‘What-if’ planning

‘What-if’ planning aka ‘scenario planning’ is typically a key function you’ll be looking for.

Through cash management we of course want to know things like the state of our accounts receivable and payable.

But why is it we want to know these things?

First off, we want to make make sure there is money in the bank, but we also want to be able to plan for what we can do with our cash (or lack there off).

That’s where scenario planning shines. Software with strong scenario planning features will not only let you view and manage your future cash flow, but add and test scenarios side-by-side.

Be sure to keep an eye on the different time horizon different software offerings

the best cash flow forecasting software for small business

There are many available options when searching for cash flow management tools. This list is not exhaustive, but it does highlight some of the best cash flow management tools out there targeted towards small businesses.

Of course, you know your business best, so prioritize features that are key to your situation, and explore your options.

Luckily all the tools we are sharing today have some sort of free option or trial period, so you can easily try them for yourself!

1. Cash Flow Tool

Cash flow tool is designed small business users and is unique to this list in that they offer a completely free lite version of their software with a limited feature set.

Key Features:

- Integrates with QuickBooks Online and QuickBooks Desktop

Provides 4-week and 6-month forecasting

Unlimited users in Plus and Pro plans (1 Users in free plan)

Includes a cash flow calendar, heat map and what-if planning

Drawbacks:

Limited to 6-month forecasting

Access to features highly dependent on which plan you choose

Pricing highly dependent on which plan you choose

Price: $US 0 -100/month (scales by plan)

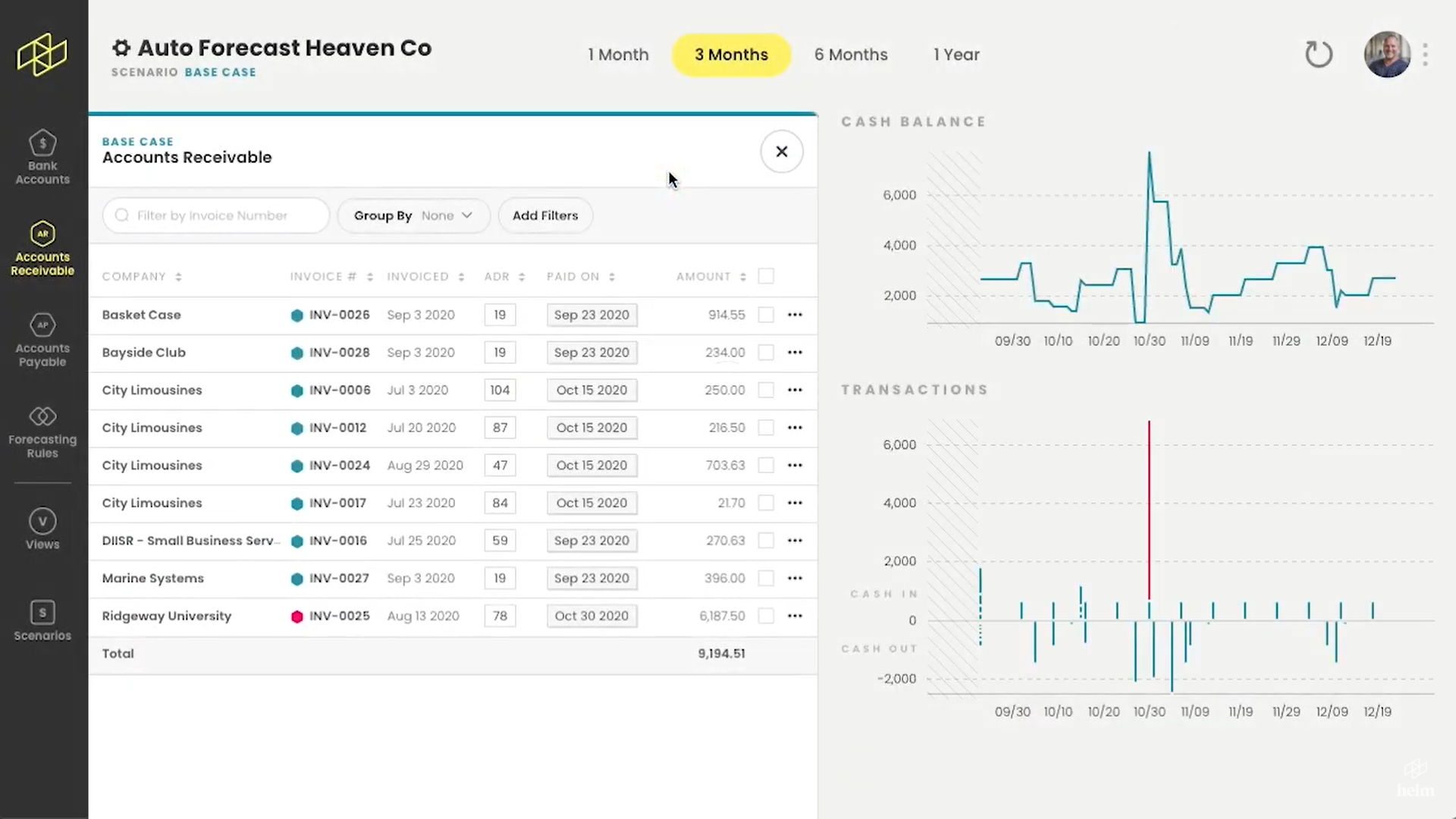

2. Helm Cash Flow

Designed by accountants and small business advisors, Helm lets you see your future cash position in real-time, so you can make confident business decisions without wasting hours planning in spreadsheets.

Key Features:

Integrates with major accounting software: QuickBooks Online, Xero, Sage and Veem.

Provides 1-month, 3-month, 6-month and 12-month forecasting with various viewing options

Unlimited side-by-side scenario planning/testing

Analyses the historic transaction data of each contact to predict how you will be paid in the future

Includes a key financial metric dashboard to help you stay on top of your business’ financial health

Drawbacks:

Limited to forecasting up to one 1 year making it best suited to short term planning.

While you can export files/reports to Google Sheets/Excel Helm currently does not support any in app budgeting.

Price: US$ 49/month

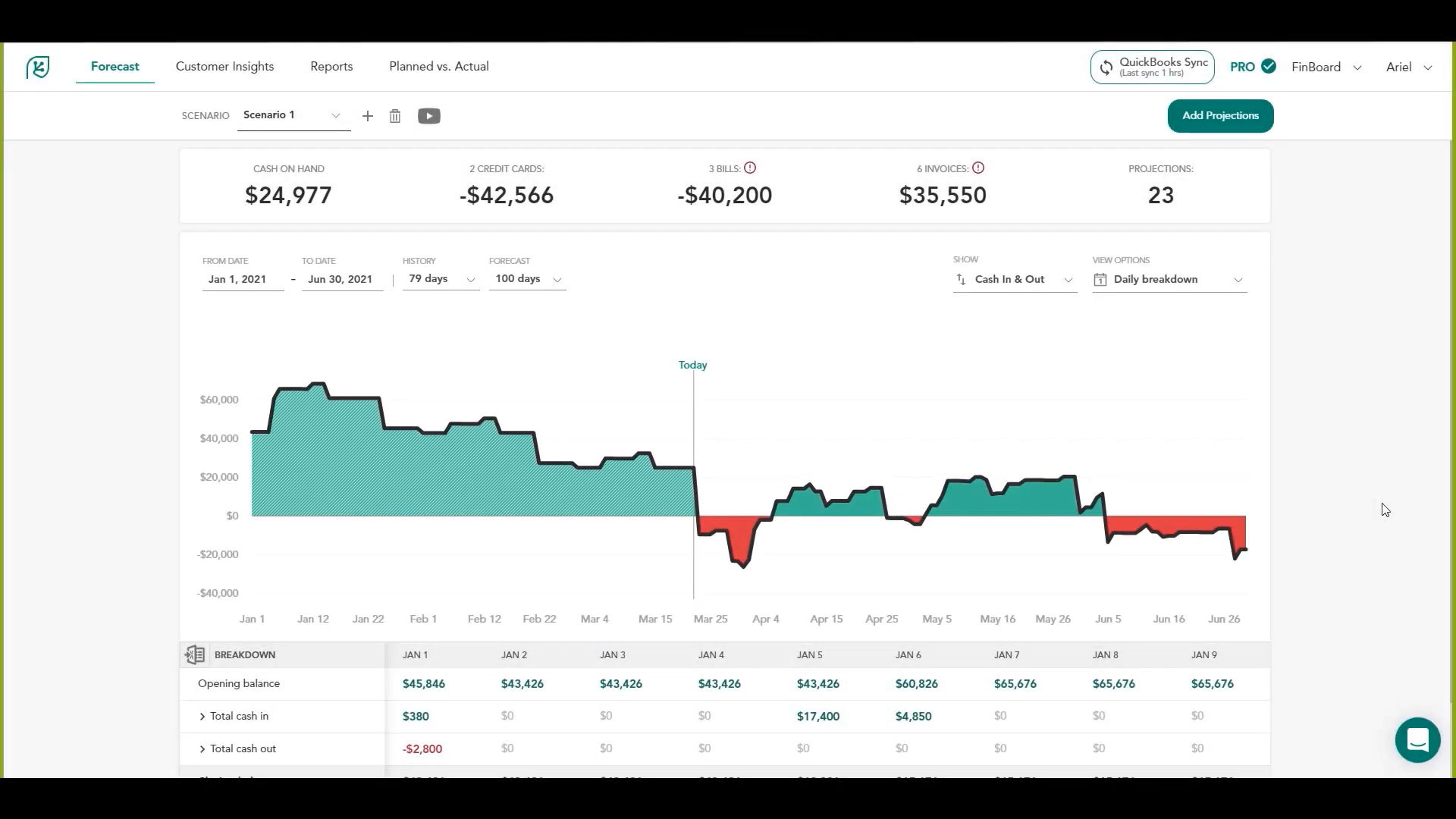

3. Cash Flow Frog

Cash Flow Frog gives you a clear picture of your business’ current cash balance and see much cash you will have at any given point in time.

Key Features:

Integrates with major accounting software: Xero, FreshBooks, QuickBooks Online, QuickBooks Desktop, and Sage Intacct

Lets you analyze and plan your cash flow up to 3 years ahead using daily, weekly, monthly and quarterly perspectives

Lets you view planned versus actual reports

Has the ability to consolidate data from multiple companies into a single cash flow forecast

Drawbacks:

The number of users is limited to 2 and 10 users for the standard and pro plans respectively

Like with users, the number of scenarios you test is limited in the standard plan to just 3

Pricing is based on your revenue (price increases based on revenue)

Price: $US 23 -95/month (scales by plan and revenue)

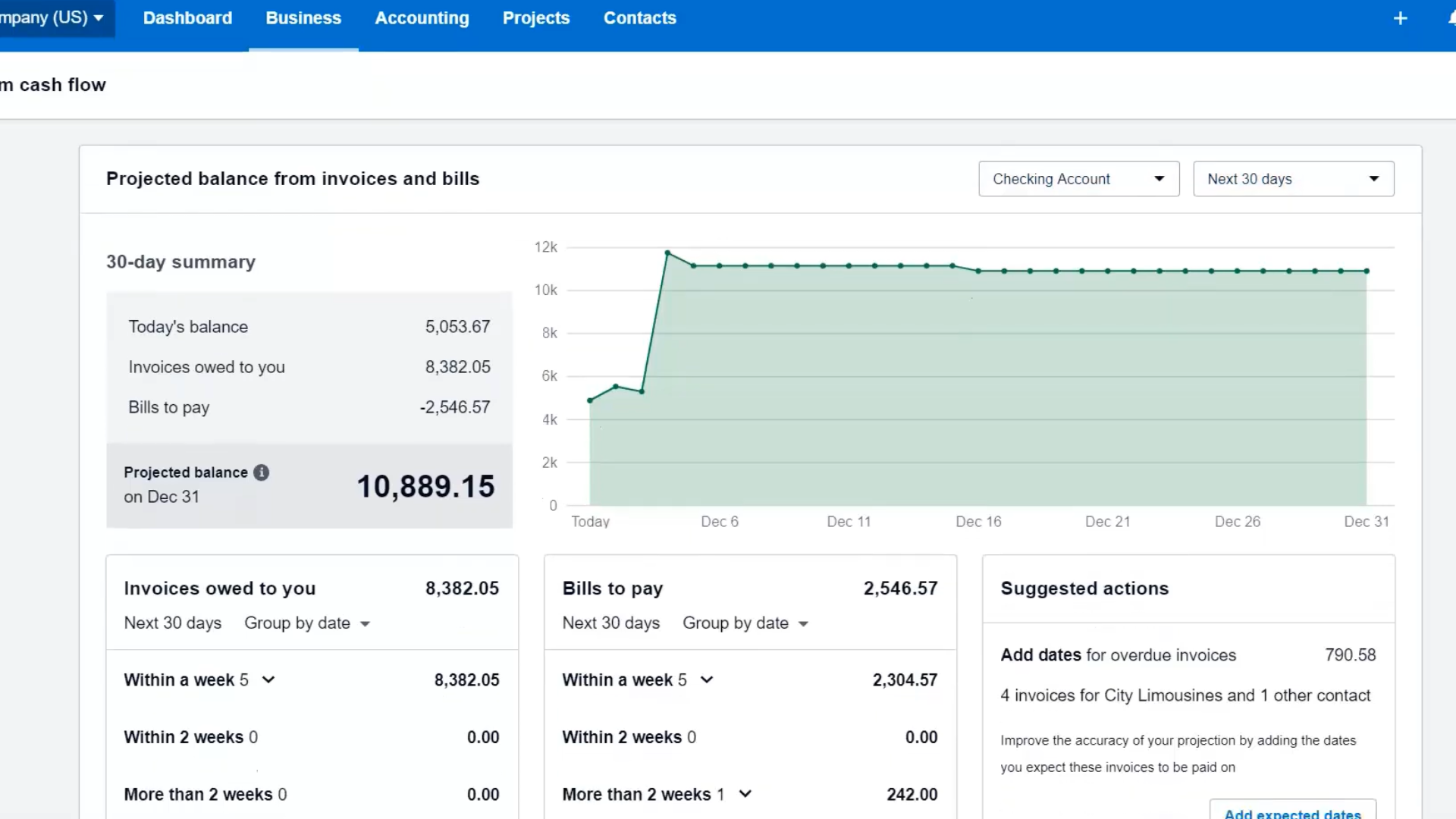

4. Xero Short Term Cash Flow Tool/Report

For existing Xero users their tool can be a great entry level place for those who aren’t doing any sort of cash management already. Plus it comes free with all levels of your Xero subscription!

Check out our guide on how to use it here.

Some Key Features:

Xero offers 7-day and 30-day cash flow reports

Allows you to see upcoming invoices/bills to paid and your projected cash balance.

Drawbacks:

Extremely limited time horizons (7 or 30-day)

Lacks any form of scenario planning to help you plan and test for the future, making it substantially less flexible than other tools on this list.

Only available for Xero users

Price: *Included with subscription to Xero

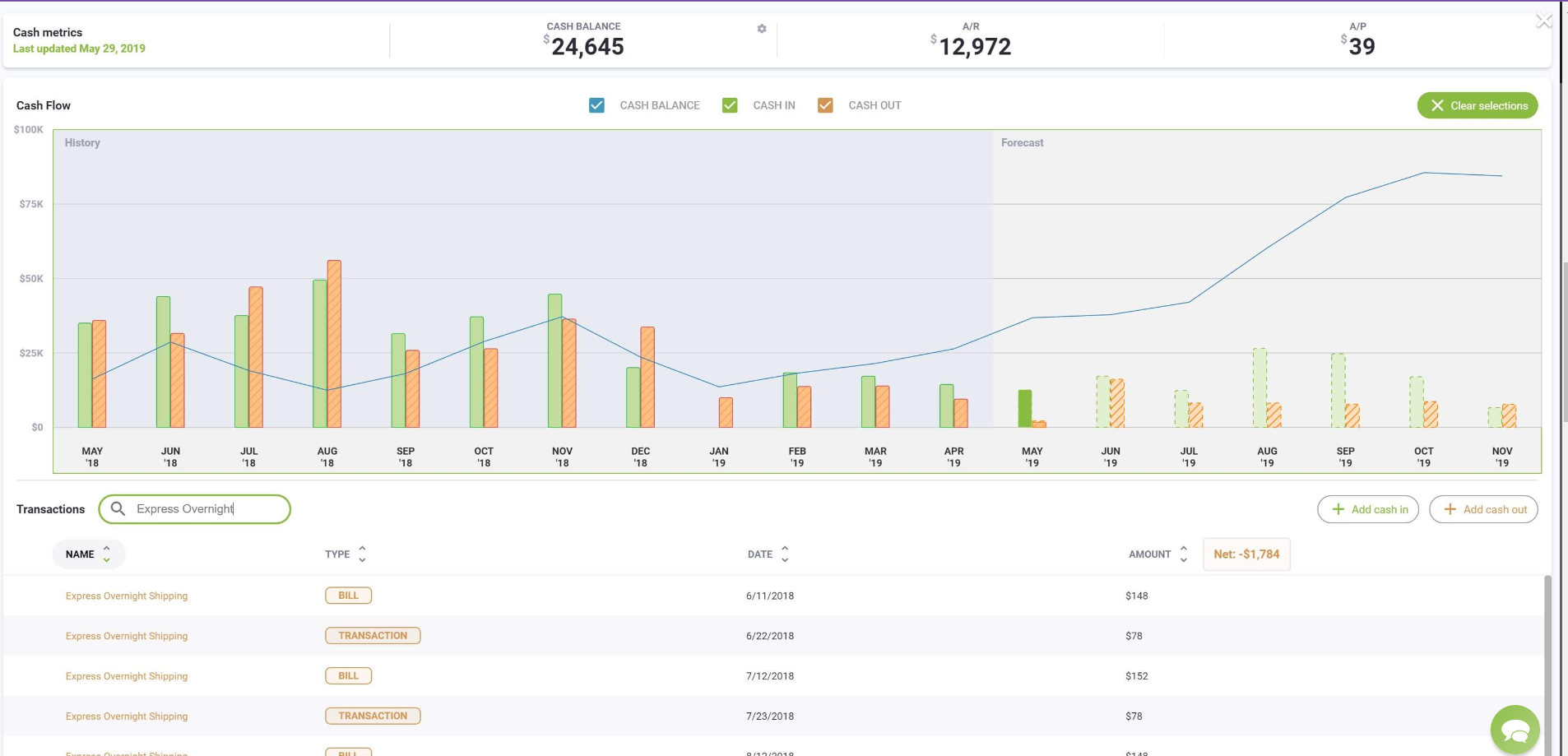

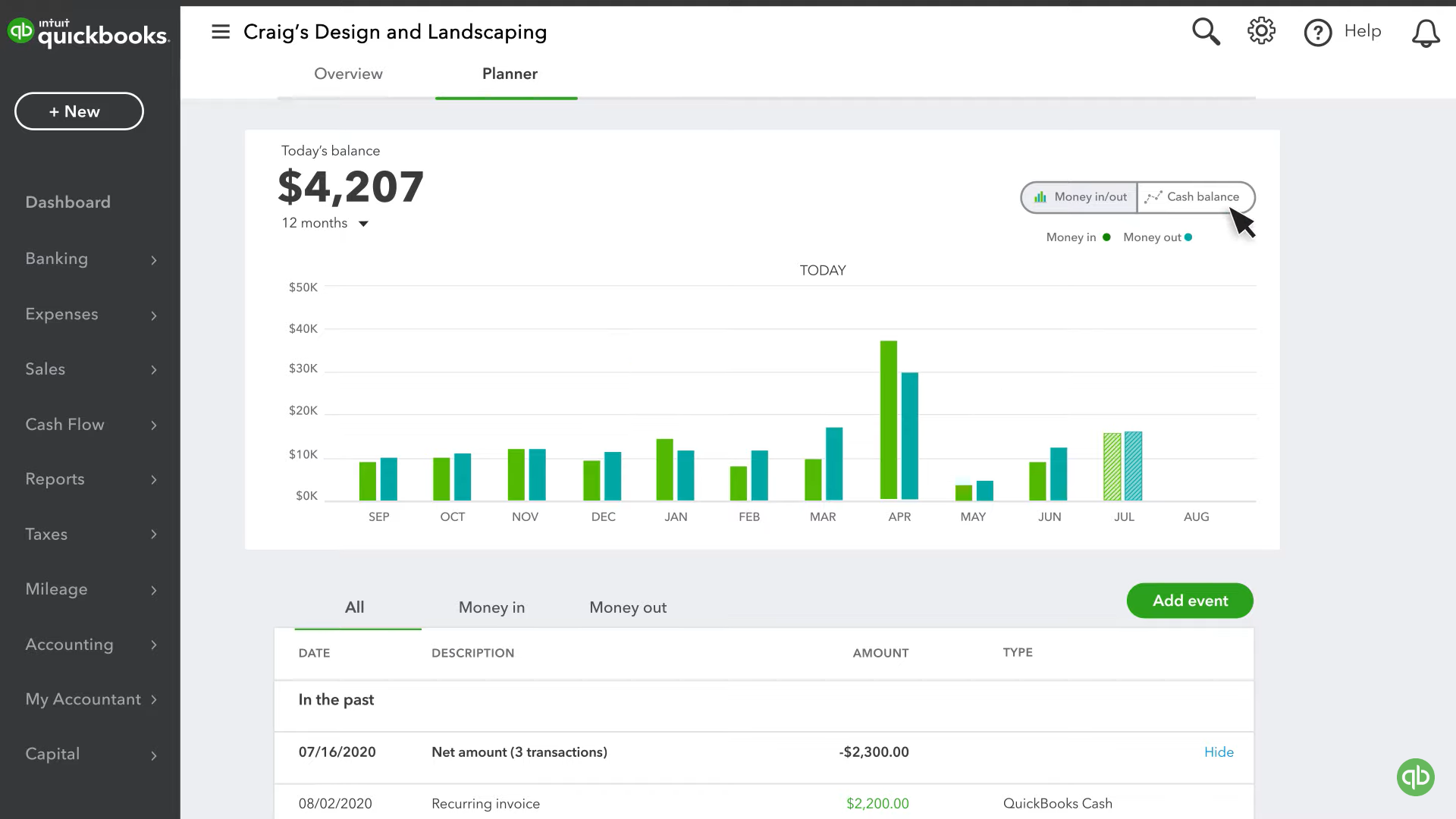

5. QuickBooks Online Cash Flow

Like Xero, Quickbooks Online offers a built-in tool free to their users. It also serves as a great starting point for newcomers to cash management. More advanced users will still likely search for advanced features elsewhere.

Check out our guide on how to use it here.

Some Key Features:

Forecasts up to 12 months

Ability to view all upcoming transactions

Basic planning features for testing future events

Drawbacks:

Lacks the ability to compare multiple scenarios

Lacks features when compared to other tools on this list

Only available for QBO users

Price: *Included with subscription to QBO

6. Fathom

-png.png)

Fathom combines insightful reporting, fast cash flow forecasting and actionable financial insights into one refreshingly easy business management solution.

Key Features:

Integrates with QuickBooks Online, QuickBooks Desktop and Xero

Includes tracking for key KPIs and financial reporting and analysis for metrics like profit and growth

Ability to create three-way cash flow forecasts that project P&L, Balance Sheet & Cash Flow statements.

Ability to schedule the delivery of timely financial reports

Allows you to create custom reports

Forecasts up to 3 years

Drawbacks:

Cash flow forecasts limited to monthly, quarterly or annually (no daily or weekly)

Price: Starting at US$ 54/month (scales with number of companies connected)

Choosing the right tool for you

Remember nobody know your business better than you. Prioritize the features most beneficial to your business to find the best cash flow management software for you.

Interested in seeing how Helm can help? Book a time to speak with an advisor here or learn more here.