When it comes to managing the finances of a small business, there are many factors to consider. One of the most important decisions a business owner makes is the hiring of accounting and bookkeeping services to assist with business finances.

While both professionals can be instrumental in ensuring the financial success of your business, there are distinct differences between their roles and responsibilities.

In this article, we explore the differences between bookkeeping and accounting and when to hire these services for a small businesses.

A look inside:

What is a Bookkeeper?

When should I hire a bookkeeper?

How much do bookkeeping services cost?

What to look for when hiring a Bookkeeper

What is an Accountant?

When to hire an Accountant?

How much does it cost to hire an Accountant?

What to look for when hiring an Accountant

Continuing to build your financial team as your business grows

First up, what’s a bookkeeper anyway?

What is the role of a Bookkeeper?

Bookkeepers are responsible for the day-to-day upkeep of a business’s financial records. They maintain accurate records of all small business finances and financial transactions, including sales, purchases, receipts, and payments.

A bookkeeper’s job also includes reconciling bank accounts, creating invoices, and managing accounts payable and accounts receivable. Additionally, they may prepare financial statements, such as a balance sheet, an income statement, a cash flow statement, and a profit and loss statement.

When to hire a bookkeeper:

Ideally soon after you start your business (if possible).

If your small business has a limited number of transactions, it may be possible to handle bookkeeping tasks on your own while you’re getting started. However, as your business grows, the volume of financial transactions will increase, making it more difficult to keep track of everything accurately.

As a small business owner you’re passion likely isn’t spending time in spreadsheets and handling financials (unless you opened a financial services business!), and you’ll want, and perhaps need, to spend more time working ‘in’ you business, rather than ‘on’ it.

If you find yourself spending too much time on bookkeeping tasks, or if you are not confident in your ability to handle these tasks effectively, it may be time to hire a bookkeeper. Bookkeepers are especially useful for small businesses that do not have a full-time accountant on staff.

If your looking to create forecast and future looking projections, accurate and up to date bookkeeping data is also essential. If the data you putting into your forecast is garbage, the output won’t be any better.

How much do bookkeeping services cost?

The cost of hiring a bookkeeper can vary depending on a number of factors such as the location, the experience of the bookkeeper, and the level of services required.

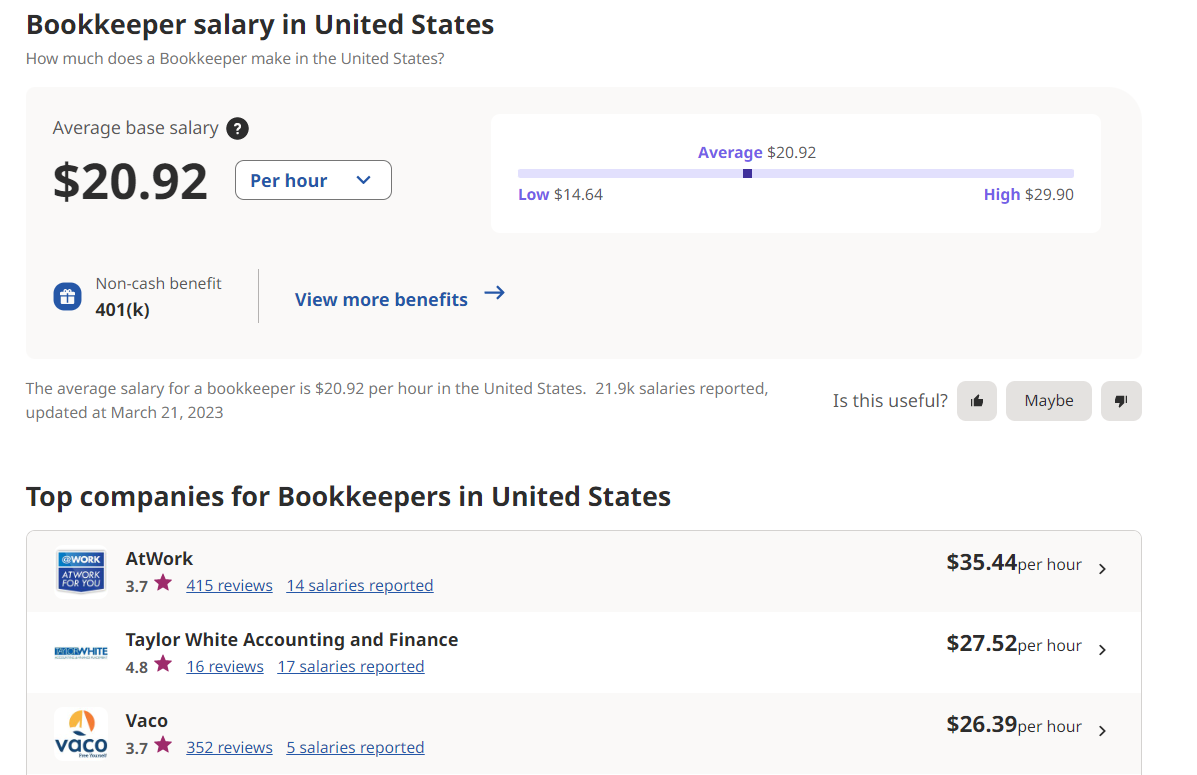

Below is a screenshot from indeed showing the average salary of a bookkeeper in the US.

Factors that can influence the cost of hiring a bookkeeper:

Location: Bookkeepers in larger cities or urban areas may charge higher rates than those in smaller towns or rural areas.

Experience: Bookkeepers with more experience and specialized skills will charge higher rates than those with less experience. Many industries have unique bookkeeping duties or specifications that may affect cost as well.

Services required: If you’re looking for a bookkeeper to handle a full range of accounting and financial tasks, including payroll and tax preparation, the cost will likely be higher than if you only need basic bookkeeping services.

Frequency of services: The frequency of bookkeeping services required can also impact the cost. For example, if you need a bookkeeper to work on a daily or weekly basis, the cost will be higher than if you only need monthly or quarterly services.

In general, bookkeepers charge anywhere from $20 to $100 per hour, with an average hourly rate of around $40 to $60 per hour. Some bookkeepers may also charge a monthly retainer fee instead of an hourly rate, which can range from $200 to $1,500 per month.

While hiring a bookkeeper can be an added cost for your business, it can also help you save money in the long run by keeping your finances organized and ensuring compliance with tax laws and regulations.

Before hiring a bookkeeper, it’s important to determine your specific accounting and financial needs and choose a bookkeeper who can provide the services you need at a fair and reasonable price.

Note: Don’t just hire the cheapest booking services you can find! While bookkeeping services have seen a recent trend of commoditized pricing, good bookkeeping is absolutely worth the extra cost!

What to look for when hiring a Bookkeeper

In the US, professional bookkeepers will have the designation of Certified Public Bookkeepers (CPB) license, or the Certified Bookkeeper (CB) designation.

In Canada, the Certified Professional Bookkeepers of Canada is a national association that offers the CPB (Certified Professional Bookkeepers) designation.

Outside of the obvious education, designations and experience here a couple things you should look for:

Industry experience: Every industry is different, a bookkeeper with experience in yours can perform tasks faster and provide financial insights based on their experience.

Familiarity with accounting software: Bookkeepers tend to work with one accounting software or the other (Xero, QuickBooks, Sage), make sure your candidates are familiar with your software. We recommend using cloud accounting software.

What is the role of an Accountant?

That covers bookkeeping, now on to small business accounting!

Accountants are responsible for interpreting financial information and providing guidance to help small business owners make informed business decisions. They analyze financial data to identify trends, patterns, and areas for improvement. They also prepare tax returns, provide tax planning advice, and offer guidance on financial management, budgeting, and forecasting. Additionally, they can assist with auditing and compliance tasks.

When should I hire an Accountant?

If your small business is growing rapidly, you may require the services of an accountant. Accountants can help you navigate the complexities of financial planning, tax preparation, and compliance.

If you’re struggling to make sense of your financial data or if you need assistance with tax planning, it is a good idea to hire an accountant.

Additionally, if you are seeking financing from investors or lenders, having an accountant on board can help instill confidence in your financial management capabilities.

How much does it cost to hire an Accountant?

The cost of hiring an accountant can vary depending on several factors, such as the size of your business, the complexity of your financial needs, and the location of the accountant. Here are some common fee structures that you may encounter when hiring an accountant:

Hourly rate: Some accountants charge an hourly rate for their services, which can range from $100 to $400 per hour, depending on their level of experience and the complexity of the work. This can be beneficial if the amount of work from month to month changes as it gives greater flexibility compared to other fee structures.

Monthly retainer/fixed-rate/flat-rate: Some accountants will charge a fixed-fee, which is a set amount paid each month for a specific set of services.

Project-based fee: For specific projects, such as tax preparation or financial statement preparation, an accountant may charge a project-based fee, which is a one-time fee for that specific service.

Percentage of assets: Some accountants may charge a percentage of the assets they manage or advise on (commonly seen with services such as investment portfolios or retirement plans).

It’s important to discuss fees and payment structures with potential accountants during the hiring process to ensure that you understand their rates and can budget accordingly.

Additionally, keep in mind that investing in a qualified accountant can potentially save you money in the long run by helping you manage your finances more effectively and avoid costly mistakes.

What to look for when hiring an Accountant

When hiring an accountant, it’s important to find someone who is not only qualified and experienced but also a good fit for your business. Here are some factors to consider when evaluating potential candidates:

Education and certifications: Look for an accountant with a degree in accounting or finance, as well as relevant certifications such as CPA (Certified Public Accountant), CMA (Certified Management Accountant), or CFA (Chartered Financial Analyst).

Experience: Consider the accountant’s level of experience, particularly in your industry or business type. An accountant who has worked with businesses similar to yours may be better equipped to handle your financial needs.

Knowledge of tax laws: An accountant should be up-to-date on the latest tax laws and regulations to ensure that your business is compliant and takes advantage of any available deductions. Keep in mind tax laws vary substantially by region!

Communication skills: Look for an accountant who is able to explain complex financial information in a clear and understandable way. They should also be able to communicate effectively with you and other stakeholders in your business.

Technology proficiency: An accountant who is familiar with accounting software and other financial tools can streamline your financial processes and help you make better-informed decisions.

Bookkeeper vs. Accountant comparison

In summary, both bookkeepers and accountants can play important roles in the financial success of a small business. Bookkeepers are responsible for maintaining accurate financial records, while accountants provide guidance financial support and advice on financial management, tax planning, and compliance.

If you are struggling to keep up with day-to-day financial tasks, it may be time to hire a bookkeeper.

If you require assistance with tax planning, financial management, or compliance, it is a good idea to hire an accountant.

Ultimately, both play a key role and work together to ensure the financial health of your business.

Continuing to build your financial team as your business grows

As your business grows so too will the financial requirements. A fractional CFO can be an excellent next step in improving your business structure and in build your financial team. For more on Fractional CFOs check out our full article on hiring a Fractional CFO for small businesses.

For more check out the resources below.

Until next time!