A fractional CFO, also known as an outsourced CFO, is a financial professional who provides part-time or project-based financial leadership to small and mid-sized businesses.

Looking at the top reasons small business fail we can quickly see a strong need for financial and strategic planning that fractional CFOs bring.

If you’re considering a career as a fractional CFO, here are some essential skills you need to possess:

The 8 skills you need to be a successful fractional CFO

Financial Expertise:

First up the obvious. They must have a deep understanding of finance, including accounting, financial analysis, budgeting, and forecasting. They should be well-versed in financial statements, tax laws, and financial compliance. Not all fractional CFOs provide the same service offerings so the expertise needed can vary.

Communication Skills:

Perhaps the must underrated or overlooked skill on this least, but also perhaps the most important. Many advisors when looking to transition their services don’t fully grasp how much communication is required for the role. Being a fractional CFO doesn’t just mean handling numbers and generating reports, it means acting as a pseudo business partner to your clients.

A fractional CFO must be able to effectively communicate with clients, employees, vendors and their finance team. Understanding complex financial concepts is one thing, explaining them to non-financial stakeholders in a way that is easy to understand is an entirely different (but equally important) skill.

Analytical Skills:

Of course the numbers are still key. A fractional CFO must be able to analyze financial data and identify trends that can help the business make informed decisions. They must be able to use financial analysis tools to forecast cash flow, identify cost-saving opportunities, and provide financial insights to clients.

Business Acumen:

Successful CFOs act as business leaders and have a strong understanding of the business landscape in which their clients operate. They must have the ability to interpret market trends and understand the competitive environment to provide financial advice that will help the business thrive.

Problem-Solving Skills:

A fractional CFO must be a critical thinker and have excellent problem-solving skills. They must be able to identify financial issues and develop creative solutions to address them.

Time Management:

As a fractional CFO time will always be your enemy if you aren’t careful. They must be able to manage their time effectively, balancing the needs of multiple clients while ensuring that deadlines are met. They must be able to prioritize tasks, delegate responsibilities, and manage their workload efficiently.

Interpersonal + Leadership Skills:

A fractional CFO must be able to build strong relationships with clients and colleagues to build trust and work effectively. As leaders of the finance team they will often lead a team of bookkeepers and accountants in managing the accounting process.

Adaptability:

If you like doing the same thing everyday fractional CFO work probably isn’t for you. A fractional CFO must be adaptable and flexible, able to adjust their approach to fit the needs of different clients and situations. They must be comfortable with change and be able to pivot quickly when circumstances require it.

A fractional CFO requires a range of skills, from financial expertise to communication skills, problem-solving, and adaptability. With the right combination of skills and experience, a fractional CFO can provide valuable financial leadership to businesses in need of expert guidance.

Don’t worry if you aren’t all-star at each and every skill (spoiler-alert nobody is!). All these skills can be developed over time and as a fractional CFO you have a lot of freedom to tailor your service offering to match you and your clients.

How to become a Fractional CFO

Interested? As we saw becoming a fractional CFO requires a combination of education, experience, and skills.

Wait!

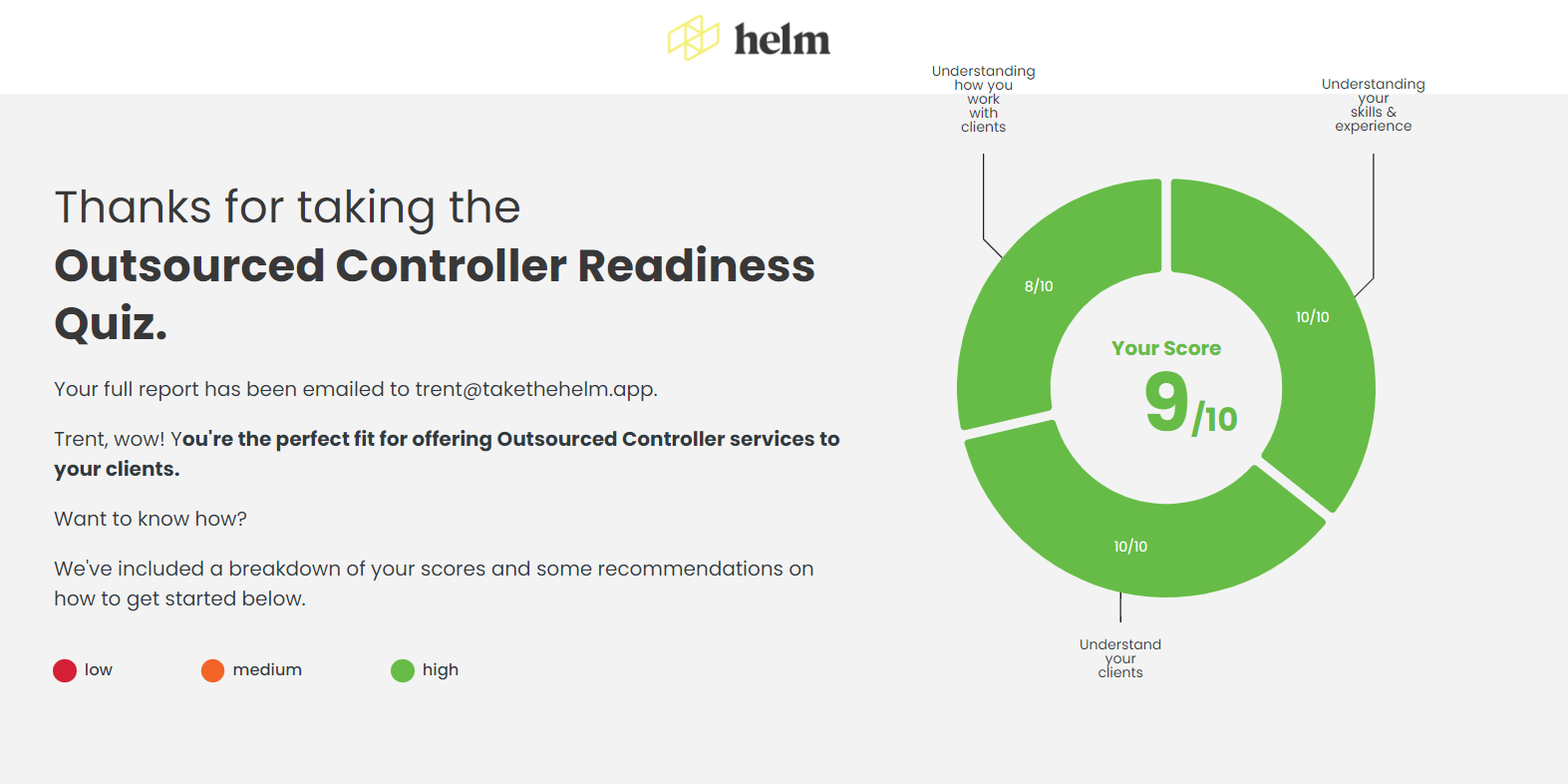

If you’re already a bookkeeper or advisor you may already have developed a large portion (if not all) the skills you need! Take our Controller/Fractional CFO Readiness Quiz to see for yourself – it only takes 3 minutes!

Here are some steps you can take to become a fractional CFO:

Obtain a degree in finance or accounting: Financial and analytical skills are key to the foundation. A bachelor’s degree in finance or accounting is a great way to learn and demonstrate your knowledge. Consider pursuing a master’s degree in finance or an MBA to gain a deeper understanding of financial management and analysis. Certifications and designations like CFA (Chattered financial Analyst) can also be very valuable.

Gain experience in financial management: Your first financial role won’t and shouldn’t a fractional CFO, you’ll need to have experience working in financial management roles. Consider working in finance or accounting positions in various industries to gain exposure to different types of businesses and financial challenges.

Develop your skills: As mentioned above, a fractional CFO needs a range of skills, including financial expertise, communication skills, problem-solving skills, and time management skills.

Build your network: Networking is crucial in the world of finance. Financial and accounting advisors get the vast majority of their clients from word of month or referrals.

Attend conferences and events to meet other financial professionals and potential clients. Join industry associations and participate in online forums to stay up-to-date on the latest trends and opportunities.

Join your peers in the Mastering Outsourced Controller group of Facebook or connect with us on LinkedIn.

Consider working with a fractional CFO firm: To gain experience and exposure to different types of businesses and industries, consider working with a fractional CFO firm. This can be a great way to build your reputation, develop your skills and learn form someone in your desired role.

Start your own business: Once you have the experience, skills, and network, consider starting your own fractional CFO business. This will require additional skills like marketing yourself/your firm to potential clients and developing a business plan, but it can be a rewarding and lucrative career path.

Becoming a fractional CFO requires education, experience, skills, and networking. By following these steps, you can position yourself for a successful career as a fractional CFO.

The roles and responsibilities of a fractional CFO

We’ve discussed

the skills you’ll need and the path you can take, but what does a Fractional CFO actually do?

The roles and responsibilities of a fractional CFO will vary depending on the needs of the client and the scope of the engagement. However, here are some common responsibilities of a fractional CFO:

Financial Reporting: A fractional CFO is responsible for ensuring that financial reports are accurate and timely. This includes reviewing financial statements, preparing financial reports, and providing analysis and insights on financial performance.

Financial Planning and Analysis: A fractional CFO is responsible for creating financial forecasts, budgets, and strategic plans that align with the company’s goals and objectives. They must also provide recommendations on how to improve financial performance and identify potential risks.

Cash Management: A fractional CFO is responsible for managing the company’s cash flow, ensuring that there is enough cash available to meet financial obligations and invest in growth opportunities.

Accounting and Compliance: A fractional CFO is responsible for overseeing the company’s accounting and financial compliance. This includes ensuring that financial records are accurate and up-to-date, complying with tax laws and regulations, and maintaining internal controls.

Strategic Financial Management: A fractional CFO is responsible for providing financial guidance to the company’s leadership team. They must be able to translate financial information into insights and recommendations that will help the company achieve its goals.

Risk Management: A fractional CFO is responsible for identifying potential risks to the company’s financial performance and developing strategies to mitigate those risks.

Team Management: A fractional CFO may be responsible for managing a team of financial professionals, including accountants, analysts, and bookkeepers.

Ultimately, a fractional CFO is a financial professional who provides part-time or project-based financial leadership to small and mid-sized businesses.

They are responsible for a wide range of financial activities, including financial reporting, financial planning and analysis, cash management, accounting and compliance, strategic financial management, risk management, and team management.

For more on their responsibilities and how they compare to other financial roles check out our full article here.

A new era of CFOs: Pros and cons

Traditional CFOs (Chief Financial Officers) and Fractional CFOs are both options for companies looking to manage their financial operations, but they differ in several ways. Here are some pros and cons of each:

Traditional CFOs:

Pros:

Dedicated focus: Traditional CFOs are fully dedicated to the company and its financial needs. They can provide a comprehensive and dedicated approach to financial management, strategy, and decision-making.

In-depth expertise: They have deep experience and knowledge in finance and accounting. They can bring a high level of expertise to complex financial issues, such as mergers and acquisitions, capital markets, and tax planning.

Strong leadership: Traditional CFOs are typically part of the company’s senior leadership team, which means they can play a key role in setting overall business strategy and decision-making.

Cons:

Cost: Traditional CFOs can be expensive, with salaries, benefits, and other compensation packages that can be out of reach for many small and medium-sized businesses.

Limited flexibility: Traditional CFOs may not be willing or able to adapt to changing business needs, which can be a disadvantage for companies operating in rapidly changing markets.

Over-reliance: Companies with a traditional CFO may become too dependent on the CFO for financial decision-making, which can lead to a lack of diversity in ideas and approaches.

Fractional CFOs:

Pros:

Cost-effective: They can be a more affordable option for companies that don’t have the resources to hire a full-time CFO. They can be hired on a part-time or project basis, which means companies can only pay for the specific services they need.

Flexibility: They can provide a high degree of flexibility, as they can be hired on a short-term or long-term basis, depending on the company’s needs.

Outside perspective: They can bring fresh and innovative ideas to a company, as they work with a variety of clients across different industries.

Cons:

Limited availability: They may not be available when a company needs them, which can be a disadvantage if a company requires ongoing financial support.

Limited integration: They may have a more limited integration into a company’s leadership team, which can make it harder to coordinate and execute long-term financial strategies.

Limited expertise: They may not have the same level of expertise and experience as traditional CFOs, which can be a disadvantage in complex financial situations.

What types of businesses can benefit the most from Fractional CFO work?

Fractional CFO services can be beneficial for a wide range of businesses, but they are particularly useful for certain types of companies. Here are some examples:

Small and medium-sized businesses: Fractional CFO services can be a cost-effective solution for small and medium-sized businesses that need financial expertise but cannot afford a full-time CFO.

Startups: Startups can benefit from fractional CFO services, as they often need financial expertise to manage cash flow, fundraising, and financial planning, but may not have the resources to hire a full-time CFO.

Nonprofits: Nonprofit organizations often have complex financial structures, including grant funding and tax-exempt status, which can require specialized financial expertise. Fractional CFOs can provide this expertise on a part-time or project basis.

Growing companies: Companies that are in a growth phase may need additional financial expertise to manage expanding operations, raise capital, and develop financial strategies. Fractional CFOs can provide this expertise without the cost of a full-time CFO.

Businesses going through transitions: Companies going through significant changes, such as mergers and acquisitions or leadership transitions, may benefit from the expertise of a fractional CFO to navigate these complex financial situations.

Overall, any business that needs financial expertise but cannot afford a full-time CFO or needs additional financial support on a short-term or project basis can benefit from fractional CFO services.

Join a Fractional CFO network

Want to develop your skills and connect with your peers? Join our Mastering Outsourced Controllership Group on Facebook and follow Helm Co-Founder, and Fractional CFO Kelvin Gieck on LinkedIn.

For more check out the resources below. Until next time!