A 4 -step plan to help bookkeepers offer controller services in the next 12-months. Plus all the basics like why you should be offering them, and answers to questions like “What does a controller do anyway?”

A peak inside:

- Why should I offer controller services?

- Am I ready to offer controller services?

- What exactly does a controller do?

- 4-step plan to transition your services over the next 12 months!

Why should I offer controller services?

According to the U.S. Bank, the average bank buffer for businesses in the US is 27 days. That means if revenue stopped, they had less than a month to live – yikes! It’s also substantially less than the amount of cash businesses should strive to keep on hand. On top of this 82% of business closures can be attributed to inadequate cash management.

This should come as little surprise, after all, proper cash management is core to any well run business, and it’s why larger cognizations have controllers!

But what about small and medium sized businesses who can’t afford their own internal team? Unfortunately as the stats show, many of them are getting left behind.

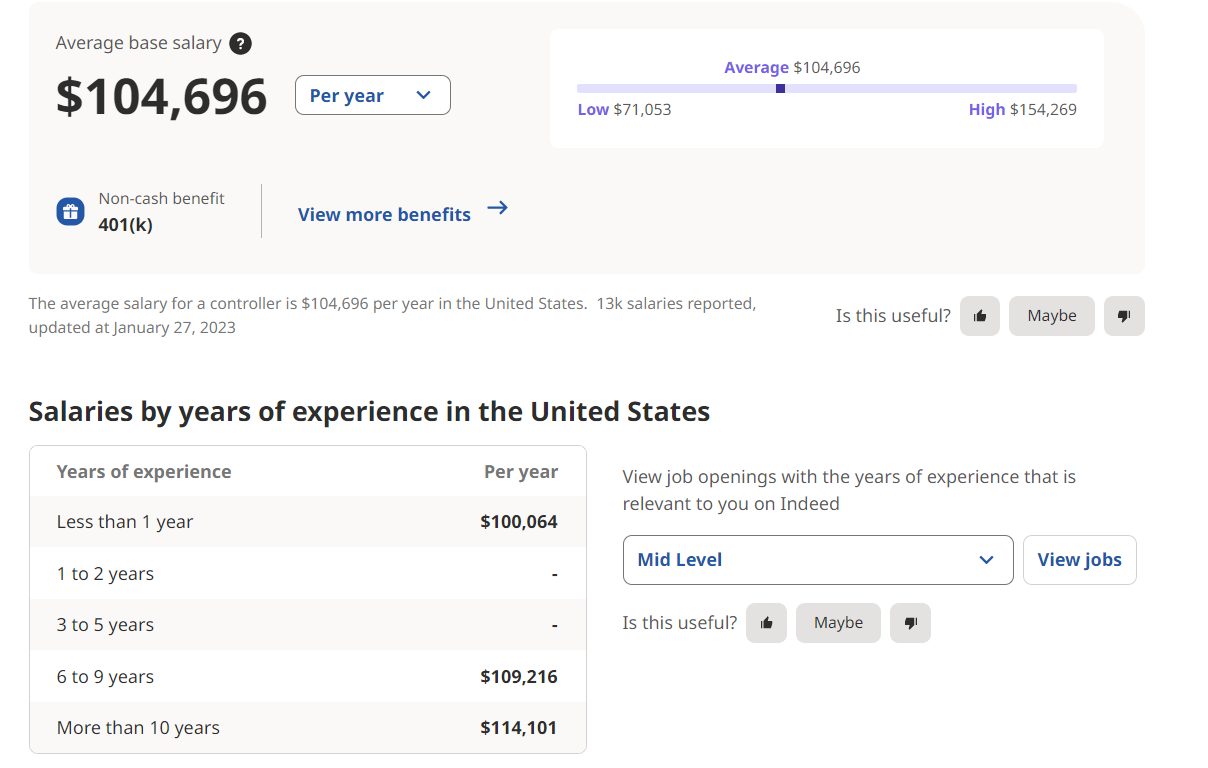

According to Indeed, the average salary for a controller in 2023 is $104,696. Even before any additional benefits, that cost is too high for the majority of businesses, after all 99% of all businesses in the US are small businesses.

That’s where YOU can step in and help your clients!

Controllership services provide not only support for your clients’ needs, but they represent an opportunity for you to escape “the grind” that can sometimes come with compliance, tax and bookkeeping work.

Controllership services allow you to:

-

Do engaging and valuable work

-

Provide greater for your clients

-

Earn higher revenue (controllers typically charge $2,000-$3,500 a client per month)

-

Generate higher margins – work less, earn more!

-

Generate a consistent monthly revenue

Are You Ready to Start Offering Controller Services?

Yes!

If your working with your clients on a regular basis, the chances are you already have the knowledge, expertise, and importantly, the trust of your clients to start offering controller services. Even if you’re just doing once a year tax work with a client or bookkeeping, our 4-step plan below shows how you can transition to controller services over the next 12 months.

But don’t take our word for it. Take the Controller Readiness Quiz (3 minutes) to see for yourself!

But we might getting ahead of ourselves a little bit. Before we go any further, “what exactly does a controller do anyway?”

Uncertain about how to approach your clients about new services? Check out our framework for talking to clients about new services.

What Does a Controller Do?

A controller is responsible for overseeing the financial operations of a business. They may work independently, or in a team leading an accounting department/team. Some controllers fill the role of bookkeeper for their clients, while others work alongside bookkeepers to help their clients.

Controllers are typically found in business with greater than $1-5 million or greater in revenue, as businesses smaller than this typically lack the complexity or resources to warrant hiring a controller.

They can be hired in-house or externally where they can take on a number of different titles including: outsourced controller/part-time controller/virtual controller/fractional CFO.

Responsibilities of a controller

-

Oversee or perform bookkeeping duties

-

Select/recommend financial software for use

-

Create cash flow forecasts

-

Cash flow management (Accounts Payable, Accounts Receivable, Cash , Loan, Line of credit, ect..)

-

Create budgets

-

Create custom financial reports

-

Analyze financial data to support business growth

Check out our article on the difference between bookkeepers, controllers, and CFOs for more.

How to Start Offering Controller Services

Now that we’ve got the basics covered, how can you start offering these services?

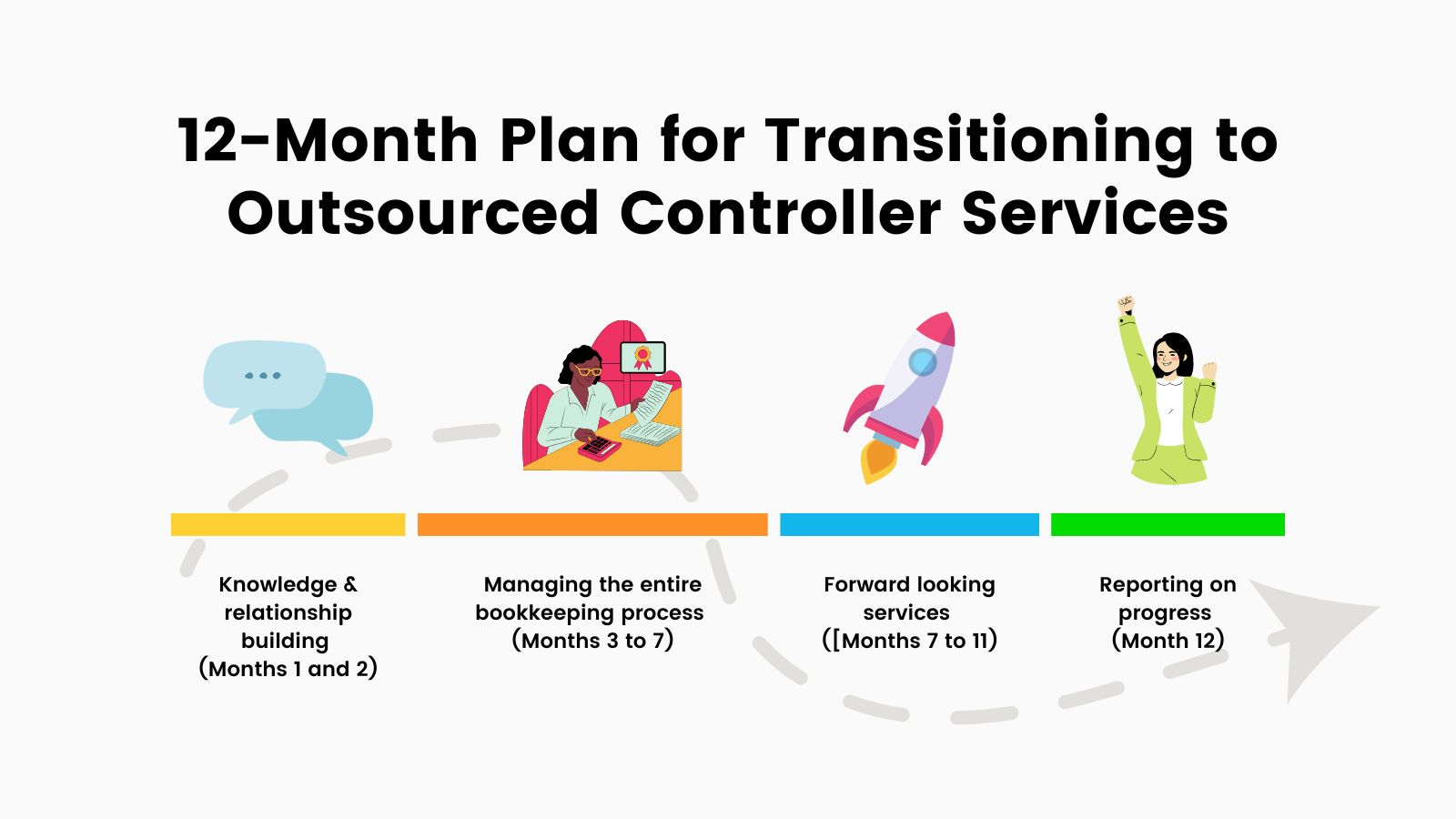

Step 1: Knowledge & relationship building (Months 1 and 2)

Our starting point is going to be assuming that you’re currently a bookkeeper, or offering yearly tax advisory.

Initially, we want to focus on gaining the level of knowledge required to provide a dynamic service (more on this below). The goal here is to advance your knowledge of the clients to a point where you are providing suggestions to them. Figure out things like: Which vendors are a priority to them? Who is the squeaky wheel? What are their pain points?

Why is our goal dynamic service?

Well put yourself in the shoes of you client, which of the following services would you find more valuable as a business owner?

-

A reactive service offering where you’re continually hounded to dig up receipts, explain spending, decide on vendor payment priorities, etc.

OR

-

A proactive service offering where you’re simply asked for final approval on an already well-laid-out plan.

By building your knowledge to a point where you’re actively making suggestions, and no longer simply responding in a reactive manner to client requests, you’ve already greatly increased your value and moved toward controllership.

Set-up meetings with clients, ask open ended questions about their wants, pains and goals, and listen! Client’s are unlikely to ask directly for ‘controllership services’ as they likely don’t even know what they are, but they will express the pain points controllership solves.

Step 2: Managing the entire bookkeeping process (Months 3 to 7)

Getting client books, technology and procedures up to speed can be a lot of work, but it pays off immensely and in perpetuity.

Here you would be:

-

Telling the client which software systems should be implemented to improve their business processes.

-

Telling them the step-by-step procedures required of every stakeholder to get financial information processed in a quick, efficient and timely manner (See our 2 essentials for good bookkeeping data).

There is value in this for you and your client.

For you, this step will set-up and make future services a whole lot easier, and a lot less time consuming. Ultimately, this means less headaches and higher margins in the future.

For the client, the more information you gain and the more decisions you can make, the less your client has to think about bookkeeping. This frees business owners to spend more time on what their passionate about (hint: it isn’t bookkeeping).

Our friend, and bookkeeping wiz Kellie Parks, had a great session on how she’s does this at last years Outsourced Controller Bootcamp. Take a look!

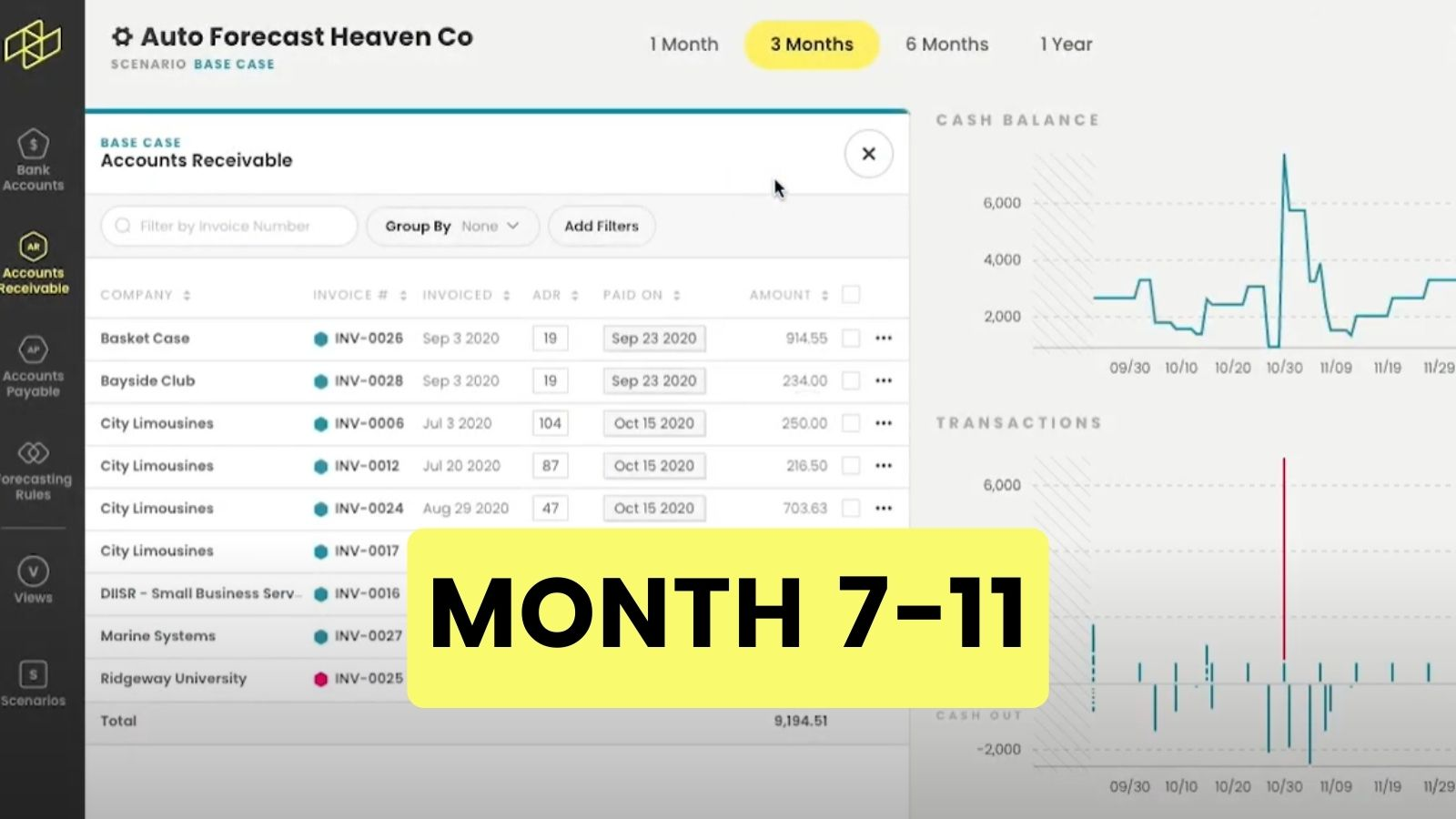

Step 3: Forward looking services (Months 7 to 11)

By now you’ve got sound processes in place and quality data is there. Now you want to collaborate with your client on what they want, and expect to see happening, with their business in the future.

A potential hurdle arises here for bookkeepers and tax advisors who are used to looking at past information. In this step, we need to train ourselves to focus on future events.

In this step you’ll be:

-

Creating budgets

-

Creating cash flow forecasts (New to cash flow forecasting? Check our starters guide and free template here)

Note about forecasting: A budget reflects what a business would like to happen, where as a forecast will show what is actually going to happen. For example, if your client’s advertising costs are continually blowing budgets, there is no point in forecasting the budgeted amount – you should be forecasting reality.

Because forecasts more accurately reflect reality, they’re created more frequently (we recommend once a month), and often have greater value to businesses.

In this step, you can see how having a dynamic and proactive relationship with your client really matters. Does your budget and forecast, incorporate future plans? Better yet, have you had a conversation about future plans, so you can build budgets and forecasts with less input (time) from your client?

Aim for monthly meetings with your client where you discuss goals and review cash flow projections. Once you have started creating budgets and forecasts for your client you can move to the final step.

Step 4: Reporting on progress (Month 12)

This last step is likely the easiest of them all, as you’ve already put the work in! Let’s recap where we are on our journey to controller services by recalling the responsibilities of a controller discussed earlier:

Responsibilities of a controller

-

Oversee or perform bookkeeping duties

-

Select/recommend financial software for use

-

Create cash flow forecasts

-

Cash flow management (Accounts Payable, Accounts Receivable, Cash , Loan, Line of credit, ect..)

-

Create budgets

-

Create custom financial reports

-

Analyze financial data to support business growth

Number 1 and 2, we accomplished in step 2. Numbers 3, 4, and 5 we just accomplished in step 3. All that’s left then is creating custom reports and analyzing data!

Reporting and analyzing

The work involved here is fairly straightforward. There is a lot of variance analysis relative to budgets and forecast updates in terms of how reality differed from the last forecast created.

This step is much less involved in terms of client input. That said, there is a lot of room for you to provide feedback and advice here (this provides a ton of value to the client in seeing where they are headed!)

This step also provides a lot of value to you, as the procedure of going through how performance is tracking, relative to expectations, gives you further insight that can be used to help your clients in the future.

Looking Forward

And just like that you’ve started offering controller services!

Up next comes pricing and marketing your services (guide coming next week, follow us on LinkedIn here!

If you’d like to see how Helm can save you hours every month and improve you cash management and cash flow forecasting you can learn more here.

Until next time!