Managing cash flow can be a challenge, especially for small business owners. In this article, we’ll take a look at 7 ways to improve cash flow management.

How to improve your business’s cash flow:

1. Accurate and consistent bookkeeping

Like with everything it’s good idea to start with the fundamentals before moving to more drastic, or dare we say, exciting steps. Good bookkeeping data allows you to reliably do things like track and forecast your cash balance overtime. If your data is poor, your outputs will be too.

Good bookkeeping data has two properties: Accurate and Consistent.

Accurately coded data means data that has been verified against source documents. Taking accuracy a step further, your bookkeeping data should be consistent, meaning it needs to be coded accurately the exact same way every time in your accounting systems (i.e. two different transactions of the same type are not recorded differently).

2. Create and maintain a cash flow

forecast

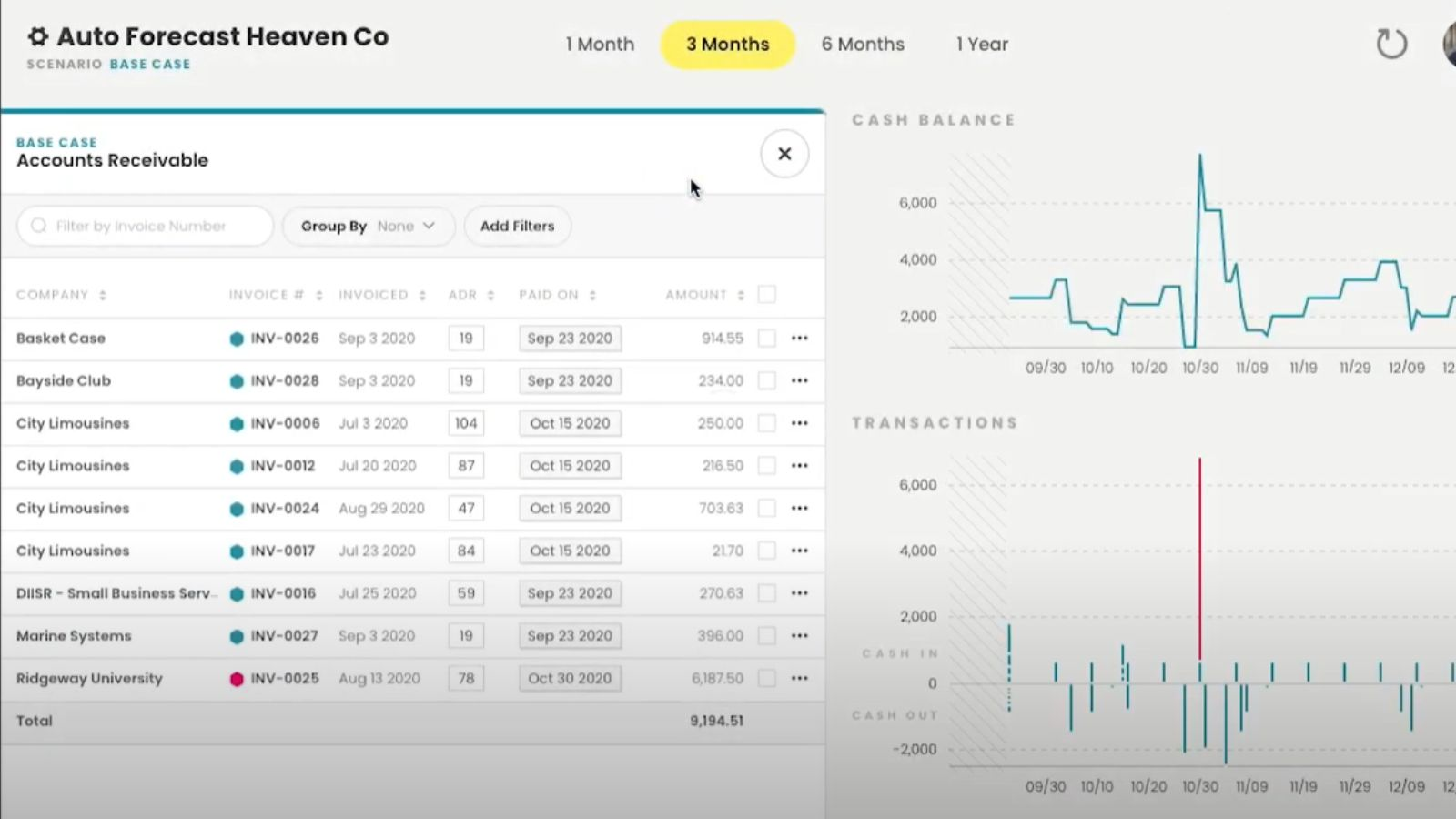

Once you know you data is in good shape you can start to leverage it to make forecasts.

A cash flow forecast is an estimate of the money coming in and going out of your business over a specific period of time. It helps you plan ahead and identify potential cash flow problems before they occur. A good cash flow forecast should be updated regularly and include a realistic assessment of your sales and expenses.

We recommend reviewing your cash flow forecast two times a month, and whenever your testing new ideas or scenarios. For example, the potential hire of a new employee, the purchase of new equipment, or when planning a new project.

We recommend using cash flow forecasting software to vastly speed up and improve this process. Learn more about the benefits of cash flow forecasting and check our list of the top 10 cash flow apps to get started.

3. Speed up your cash collection

One of the most effective ways to improve your cash flow is to speed up your cash collection.

This can be achieved by setting up clear payment terms, offering discounts for early payment, and sending out invoices promptly. You can also consider using automated payment systems to make it easier for customers to pay you.

Send invoices on the day of service

Most importantly make sure you are sending invoices and reminders out! You’d be surprised how many small business fail to send invoices promptly. Sometimes this is due to an honest mistake, or an odd transaction that falls through the cracks. Other times its due to a lack of a plan:

Follow Up Plan With Invoice Reminders

Be sure your invoicing and have a collections communications plan. Check out our free plan + templates here

4. Consider financing options / Use invoice

factoring or short-term loans

If you need to improve your cash flow quickly, you may want to consider financing options such as a line of credit, a business loan, or invoice financing. You could also consider options like Quickly who offer early payment for a fee.

These options can help you access the cash you need to cover your expenses and grow your business. However, it’s important to consider the costs and risks associated with each option before making a decision.

5. Manage your inventory

Inventory can be a significant drain on your cash flow, careful management of inventory can improve your cash flow.

By keeping your inventory levels as low as possible, while still meeting customer demand, you reduce your storage costs and free up cash for other purposes. You can also consider using just-in-time inventory management, which involves ordering supplies only when they’re needed.

6. Reduce your expenses

Reducing your expenses is a simple way to improve your cash flow. After all, if you’re spending less you’ll have more cash, but it’s not always possible.

Look for areas where you can cut costs without sacrificing quality. For example, you can negotiate better prices with suppliers, reduce energy costs by switching to energy-efficient equipment, or cut back on non-essential expenses like travel and entertainment.

7. Negotiate payable and receivable terms

We just mentioned it the reducing expenses section, but we believe payment terms are important enough to have their own section.

For both your receivables and payables consider negotiating discounts into your terms.

Negotiate quick payment terms

On the receivables side if you’re are trying to increase cash flow and the rate at which you collect consider offering a discount for early or on time payments, and/or penalties for late penalties. This incentives clients to pay early and increases the speed cash flows into your business.

We prefer early payment incentives over late penalties as these can sometimes cause friction, or damage business relationships hurting your business operations in the long term.

Example: You could offer a 10% discount for payments received within 15 days.

Check your accounts payable terms

On the flip side take advantage of discounts offered by your suppliers. If you have forecasted an excess of cash in the future you can pay suppliers early benefit from discounts.

If you have available cash using it to make payments early and receive a discount can save your business a substantial amount. Be sure though that you aren’t using cash you need by checking your cash flow forecast first.

Why is cash flow important to a small business?

Cash flow is extremely important to small businesses for several reasons:

Meeting financial obligations:

Cash flow enables a small business to meet its financial obligations, such as paying suppliers, employees, rent, utilities, and other bills. Without positive cash flow, a small business may struggle to pay its bills on time, which could lead to late fees, penalties, and damage to the business’s credit score.

Managing growth:

Businesses need cash to invest in growth opportunities, such as expanding into new markets, launching new products, or hiring additional employees. Positive cash flow allows businesses to make these investments without relying on debt or outside funding.

Managing emergencies:

Well managed cash flow and a cash reserve give businesses a cushion to manage unexpected emergencies or downturns in the economy. For example, if a business experiences a sudden drop in sales or an unexpected expense, those with well managed cash are more likely to able to weather the storm without having to resort to layoffs or drastic cost-cutting measures.

Also see: How much cash should a business keep on hand?

Planning for the future:

While all business need to plan for the future, small businesses are the most concerned with the next 3,6 and 12 months. Properly managed cash helps ensure your business with meet all its obligations while also allowing you to forecast and plan for the future confidently.

What are some early signs of cash flow problems?

We’ve looked at ways of improving cash flow, but what are some signs that cash flow could be an issue?

Late payments:

If you notice you are having to consistently pay late, this can be a sign that cash flow is tight and the business is struggling to keep up with its bills.

Increased borrowing:

If your business is borrowing more money than usual, this can indicate that it is struggling to generate enough cash to cover its expenses.

Declining sales:

If your business is experiencing a decline in sales, it may be an early warning sign that cash flow is becoming an issue.

Increasing accounts receivable:

If your business has a large amount of outstanding invoices and is not collecting payments in a timely manner, this will likely lead to cash flow negative cash flow.

Reduced cash reserves:

If your find yourself dipping into cash reserves this may be a sign of a greater cash flow issue.

Limited access to credit:

If your business is having difficulty securing credit or financing, it may be an indication that lenders are concerned about the business’s ability to repay loans.

For more cash tips check out the resources below!