Budgeting vs. Financial Forecasting: An Overview

Budgeting and cash flow forecasting are both critical aspects of financial planning for individuals and businesses. While they may seem similar, they serve different purposes and require different approaches. In this article, we will discuss the differences between a budget and a cash flow forecast.

A peak inside:

- High Level Differences Between Budgets and Forecasts

- What’s a Budget + How Can a Budget Help With Financial Planning?

- What is Cash Flow Forecasting?

- How to Create a Cash Flow Forecasts

- What Are The Key Differences Between Budgeting and Forecasting?

- Understand Budgets vs Cash Flow Forecasts

- Should You Create a Budget or a Forecast For Your Business?

High Level Differences Between Budgets and Forecasts:

Budgets are what a business would like to happen during a specific period.

Forecasts are what is likely/predicted to actually happen.

Budgets are typically focused on the sum for total period of time (ex: Expenditure for rent in 2023 will be $25,000).

Forecasts are focused on the timing of in and outflows of cash (ex: On July 30th there will be an outflow of $2,083.33 for rent).

Forecasting shows a business where they’re going, estimating future in and outflows.

A budget acts as a baseline to compare actual and expected performance.

What’s a Budget + How Can a Budget Help With Financial Planning?

A budget is a financial plan that outlines the expected income and expenses for a given period(usually a year). It’s a comprehensive plan that takes into account all the expected sources of income, including salaries, investments, and loans, and all the expected expenses, including rent, utilities, food, transportation costs, and other bills.

The budget allows individuals or businesses to allocate their resources effectively and ensure they don’t overspend in any area.

A budget helps businesses set financial goals and track their progress towards those goals. It also helps them make informed decisions about where to invest their resources, which can help them grow their business and increase their profitability.

Budgeting is a crucial component of financial planning, and businesses and companies that neglect to budget often find themselves in financial trouble.

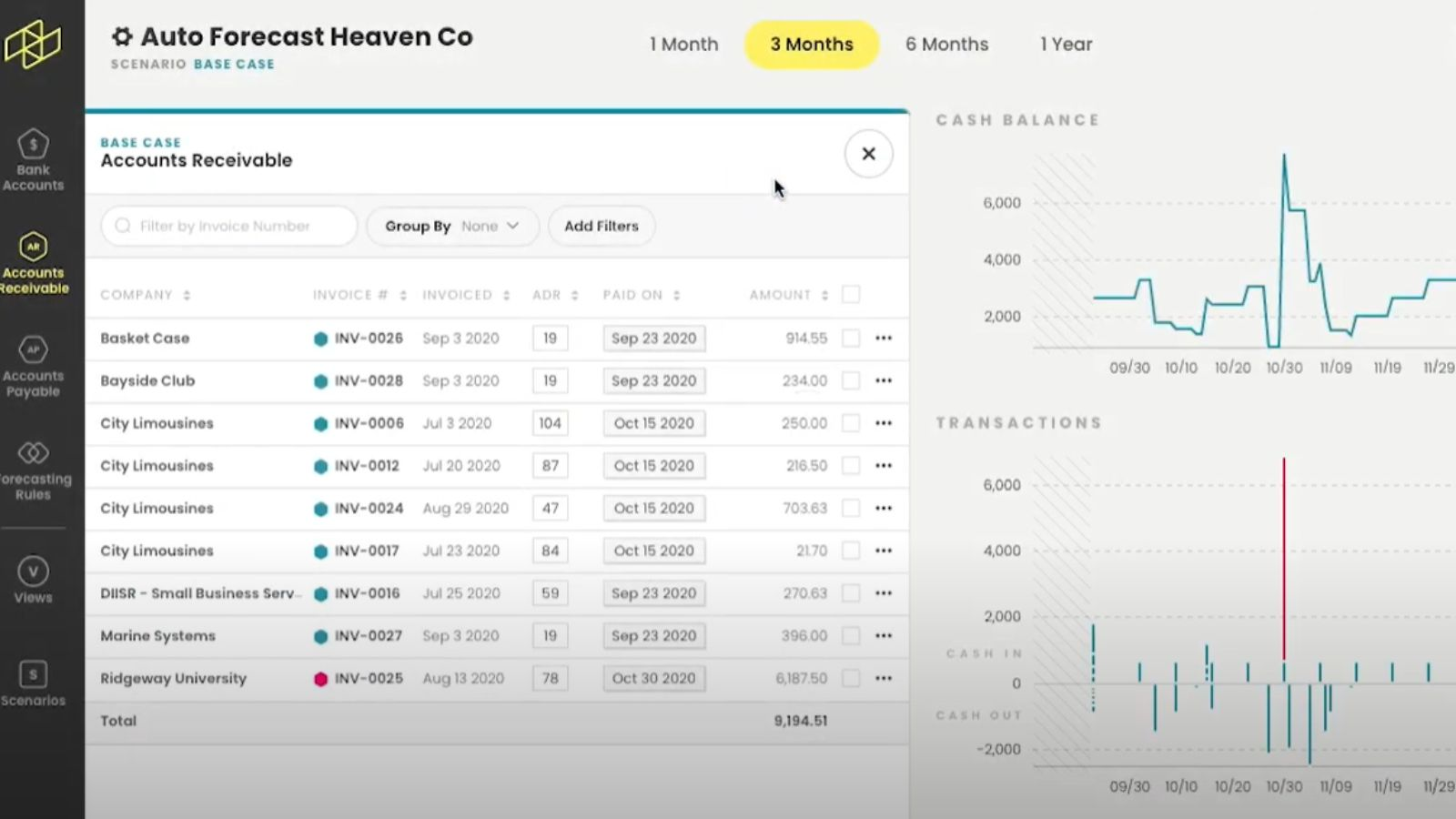

What is Cash Flow Forecasting?

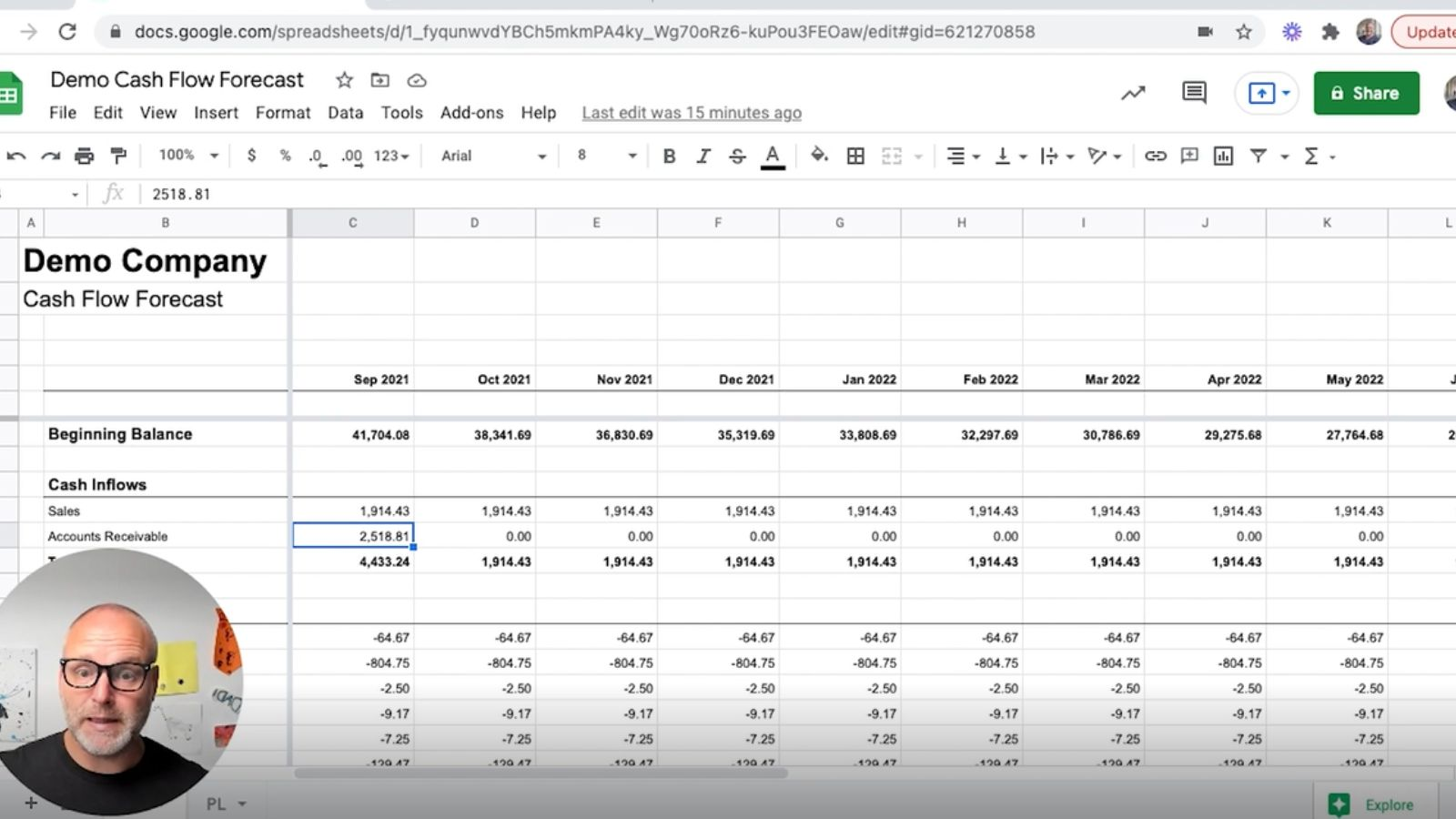

A cash flow forecast is a financial plan that outlines the expected cash inflows and outflows for a given period (usually a month, quarter or year). Unlike a budget, which looks at income and expenses over a year, a cash flow forecast focuses on the timing of cash flows, such as when payments are due and when income is expected to be received.

A cash flow forecast helps businesses manage their cash flow by predicting when they will have cash available and when they may experience cash shortages. By predicting future cash shortages, businesses can take steps to mitigate them, such as negotiating payment terms with suppliers, delaying non-critical expenses, or seeking additional financing.

Cash flow forecasting is especially critical for businesses that are growing rapidly, as they may need to invest in new equipment or hire additional staff to meet increased demand. Without proper cash flow management and forecasting, these businesses may find themselves unable to pay bills on time or take advantage of growth opportunities.

How to Create a Cash Flow Forecasts

Creating your forecasting may seem dauting but it doesn’t have to be difficult. Check out our list of the top 10 forecasting apps for small businesses, or learn how to build your own forecast with our FREE spreadsheet template + guide.

What Are The Key Differences Between Budgeting and Forecasting?

One of the main difference between a budget and estimates in a cash flow forecast is the time period they cover. A budget covers a year or longer and focuses on income and expenses, while a cash flow forecast (generally) covers a shorter period and focuses on the timing of cash inflows and outflows.

Another key difference is that a budget is a comprehensive plan that takes into account all the company’ expected sources of income and expenses, while a cash flow forecast is more focused on cash movements. A cash flow forecast helps businesses manage their cash flow by predicting when they will have cash available and when they may experience cash shortages.

Understand Budgets vs Cash Flow Forecasts

Both budgeting and cash flow forecasting are essential components of financial planning. While they may initially seem similar, they serve different purposes and require different approaches.

A budget is a comprehensive plan that takes into account all the expected income and expenses for a year, while a cash flow forecast focuses on the timing of cash inflows and outflows.

Both tools are critical for businesses to manage their finances effectively and achieve their financial goals.

Should You Create a Budget or a Forecast For Your Business?

Ideally you’d be creating and maintaining both, but if you had to choose one, which one should you create for your business?

The decision to create a budget or a forecast depends on your business’s specific needs and financial situation.

If your business has a stable income and expenses, a budget may be more suitable. If your revenue and expenses are extremely stable and consistent you’ll likely get more value from a budget, and reserve forecasting for special projects.

However, if your business has irregular cash flows or fluctuating revenue and expenses, a cash flow forecast may be more appropriate. Financial forecasts will show you how much money you’ll have in your bank account over time and whether you’re ever at risk of dropping too low or showing when you’ll have excess cash on hand you can put to work.

Typically business are concerned about the overall spending and the timing, so, in most cases, its likely beneficial to create both a budget and a cash flow forecast. A budget can help you plan your finances for the upcoming year, while a cash flow forecast can help you manage the timing of cash flows and plan for different scenarios.

Additional Resources

Interested in more on cash management and forecasting? Check out some of our other resources below:

Until next time!